With the 30-year in the 7% range and home prices continuing to rise, the typical home buyer is feeling quite miserable about the prospect of buying a home.

Some 82% of consumers said that it was a “bad time to buy a home” in July, up from 78% in June, according to a survey released Monday by Fannie Mae

FNMA,

Fannie Mae releases the survey as part of its monthly Home Purchase Sentiment Index. The index rose in the latest July report, by 0.8 points to 66.8.

Consumers cite high home prices and unfavorable mortgage rates, said Doug Duncan, chief economist and senior vice president at Fannie Mae.

“Further, the share of consumers expecting home prices to continue to rise has also been on a steady climb since March, which may only add to perceptions of unaffordability,” he added.

Home prices may continue to stay elevated as few homeowners indicated their interest in selling in the survey, Duncan added. About 64% of respondents said it was a good time to sell a home, which was unchanged from the previous month.

The “good time to sell” component has “not seen much movement” in recent months, he noted, “an indication that the current low levels of existing homes for sale will likely continue to persist in the near term.”

So what’s going on? The 30-year fixed-rate mortgage rate could stabilize around 6% in the near term, but could go lower in a more optimistic scenario over the next couple of years, research suggests.

Melissa Cohn, regional vice president at William Raveis Mortgage, told MarketWatch last month that her “ideal” mortgage rate would be 3% to 4%, but acknowledges that those rates were historic lows seen during the pandemic.

Sales of previously-owned homes fell 3.3% in June, according to the National Association of Realtors, primarily due to a shortage of homeowners selling their houses. The price of a typical resale home was $410,200, the second-highest price since 1999 when the NAR began tracking the data.

What’s more, about 4 in 10 respondents said that they expected home prices to rise in the next 12 months, Fannie Mae said. However, nearly half of those polled still expect mortgage rates to go up, while 38% expect them to stay the same.

“While consumers are reporting confidence in the components related to their personal-financial situations, it’s unlikely we’ll see housing sentiment catch up to other broader economic confidence measures,” Duncan added, “until there is meaningful improvement to home purchase affordability.”

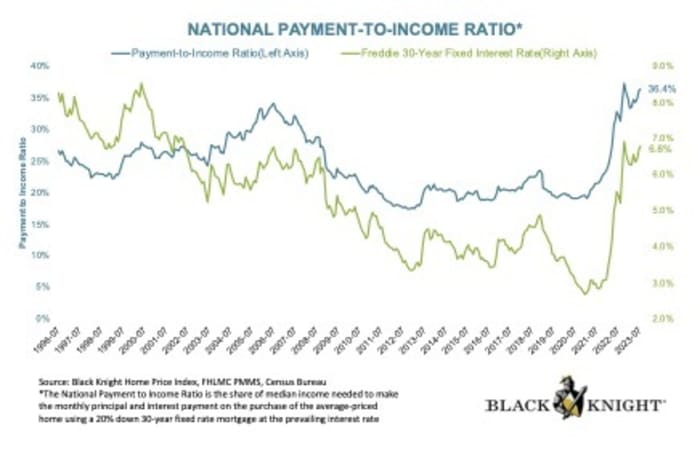

The typical monthly payment, including the principal and interest required to purchase a $443,000 home in July, was $2,308, according to Black Knight.

That means a household earning median income would need to spend 36% of their wages on their mortgage. That is the second-highest mark in the last 37 years, the company said.