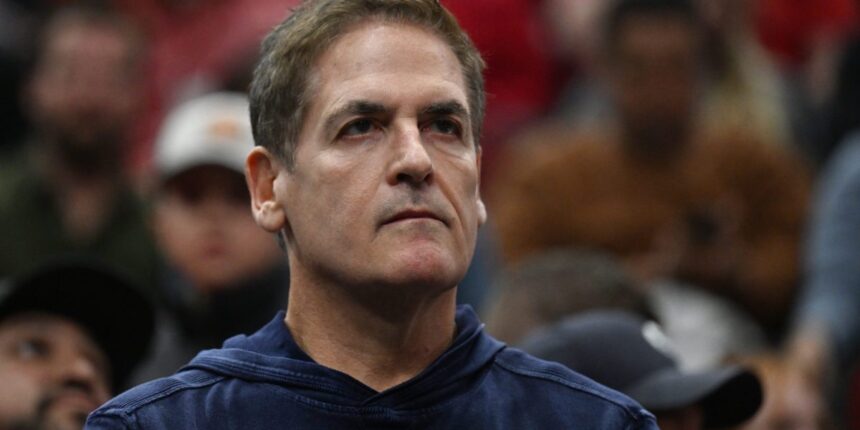

Billionaire Mark Cuban had what he thought were good reasons for not investing in Uber in 2009. But nearly 15 years later, he still deeply regrets not doing so.

In 2009, Uber cofounder Travis Kalanick approached Cuban about making an investment in Uber at a valuation of $10 million. The ride-sharing giant’s market capitalization now stands at about $90 billion.

Cuban described the missed opportunity on a recent episode of Hart to Heart, Kevin Hart’s talk show on the Peacock. “I said, ‘I’ll do it at [a] $5 million valuation,’” the Shark Tank star recalled.

He foresaw the regulatory pain that Uber would suffer and warned Kalanick that taxi commissions would “try to put you out of business.” Uber, of course, overcame such obstacles and various controversies on its way to its current valuation.

Had Cuban made the $250,000 investment in Uber in 2009, that investment would now be worth $2.3 billion.

“I’ve done OK, but still,” said Cuban, who later cofounded Cost Plus Drugs—currently roiling companies like CVS and Cigna Group—and owns the Dallas Mavericks.

Kalanick didn’t come back to Cuban about the Uber offer. “He got somebody else,” Cuban says, adding, “Whoops.”

Cuban’s net worth is now estimated at more than $5 billion, so he’s hardly suffering. But even billionaires can feel the sting of a missed opportunity for years to come.

In 2017, he ruminated on his Uber mistake at the SXSW conference, saying, “When you are trying to disrupt something like Travis was doing, sometimes you have got to be ready, fire, aim, and just bust through doors and figure you will deal with the regulatory issues later.”

He added, “If you really believe and you really have something that you think is going to disrupt the world, bring it to me. I won’t make the same mistake twice.”

Cuban noted that he himself, as a cofounder of a startup called Broadcast.com, had once been a young entrepreneur forging ahead despite regulatory hurdles. Yahoo bought Broadcast.com for $5.7 billion in 1999.

Cuban is not the only one to pass up on golden opportunities, of course. In 2000, Blockbuster had a chance to buy Netflix for $50 million. Netflix’s market cap today stands at about $180 billion, while Blockbuster has largely faded from memory.

Blockbuster’s CEO at the time, John Antioco, deemed Netflix a niche business and said “the dot-com hysteria is completely overblown,” according to a 2019 book Netflix cofounder Marc Randolph wrote about the streaming giant’s beginnings. In April of this year, Randolph tweeted that Blockbuster executives “laughed us out of the room.”

Cuban didn’t exactly laugh Kalanick out of the room—he even said he “loved” his idea. The valuation put him off, however, and Kalanick “never came back to me.”