(Bloomberg) — Markets have turned against the UK for the second time in under a year as the outlook for inflation and growth darkens for an economy that’s already lagging behind the other Group of Seven nations.

Most Read from Bloomberg

With the Bank of England struggling to rein in spiraling prices, investors have ratcheted up bets that interest rates will rise to their highest level in 25 years. The pound has drifted further away from those expectations than at any time since then Prime Minister Liz Truss’s ill-fated budget rattled markets in September.

While investors gave her successor Rishi Sunak credit for stabilizing the situation earlier this year, two crucial reports in the past month showed stubbornly strong wages and prices — despite the quickest increase in borrowing costs in three decades.

“Markets are questioning the credibility of UK policy,” said Adam Cole, chief currency strategist at RBC Capital Markets. “The wedge between rates and the currency is not yet as wide as it was at that time, but it is moving in the same direction.”

The next two weeks will be pivotal in shaping the outlook.

On Sunday, BOE Governor Andrew Bailey speaks in France and then appears the next day alongside Chancellor of the Exchequer Jeremy Hunt at the Mansion House in London. Official jobs data is published on Tuesday and monthly GDP data on Thursday. Inflation figures for June are released on July 19.

Bailey told BBC Newsround on Thursday the he does “expect quite a marked fall in inflation” in the coming months, but another overshoot in wage growth or consumer prices would redouble concerns that the BOE may have to overtighten policy and cause a recession.

Policy makers who as recently as March were weighing when to press pause on rate hikes have shifted rapidly toward a more aggressive stance, delivering a surprise half point hike to 5% last month.

Investors are now betting the BOE will have to lift its key rate to above 6.5% to cool inflation, which is the highest in the G-7.

The sudden loss of faith has renewed talk that UK is “turning itself into a submerging market,” as former US Treasury Secretary Larry Summers put it during the crisis last year. The UK is the “stagflationary sick man of Europe,” said Bank of America chief investment strategist Michael Hartnett. Cole warned that “betting on an unexpected decline in inflation in the near-term would seem like the triumph of hope over experience.”

In place of Truss, it is now the BOE’s ability to meet its inflation-fighting target that is the focus of concern.

“If the bank had credibility, they would be able to resist some — not all — of the market push for higher rates,” said Gerard Lyons, chief economic strategist at NetWealth. “But because the bank lacks credibility, it is responding to, not leading, the markets.”

Negative market sentiment is having real consequences. While the pound is the best-performing G-10 currency this year, the Treasury this week paid the highest interest rate for a new bond issuance since 2007. Mortgage costs are increasingly unaffordable — a full percentage point above the 5% pain threshold the BOE has identified as a significant burden for households. House prices are falling at their sharpest pace since 2011. Corporate insolvencies are near historic highs.

And yet the economy is more resilient than expected, Bailey has said, with worker shortages supporting wages. “This keeps the pressure on the Bank of England to hike rates further,” said George Buckley, European economist at Nomura.

It’s a dramatic fall from grace for the UK in the year that marks the first anniversary of Boris Johnson’s resignation.

Not long ago, Britain took pride in its half-way house economic model – a pic’n’mix bag of US free market and European welfare state policies. Low-ish taxes, low unemployment, flexible labor markets, and universal healthcare. The UK habitually grew faster than European peers without the social divisions that blight America. Today, it is the world’s cautionary tale.

Italy’s premier Georgia Meloni planned a Truss-style assault on state institutions until the UK budget sent market interest rates soaring in September. In the process, Britain gave the International Monetary Fund a convenient real-time example of why cutting taxes into an inflation shock was a bad idea.

Foreign investors are voting with their feet. France has overtaken Britain to top the European investment tables compiled by EY since 2019, and the FTSE 100 has been left out of a stock rally that swept the US, Europe and Japan this year. Industrial gems like semi-conductor maker Arm are listing abroad.

What Bloomberg Economics Says …

“The upcoming batch of UK jobs data will be crucial in determining the Bank of England’s next policy decision in August — another outsized 50-basis-point hike might still be on the cards. Irrespective, the British economy is set to contract in May, as the extra national holiday likely dragged on activity.”

—Dan Hanson and Ana Andrade, Bloomberg Economics. Click for the WEEK AHEAD.

Business leaders blame the declinist narrative on a lack of political vision. Brexit was a negation of Britain’s economic model — an EU single market access point with limited labor laws, not a statement of what the UK would be. That remains undefined.

Sunak wants lower taxes and strong public services but insists tax cuts will come only when the UK can afford them. With higher rates adding around £20 billion a year to the debt, the Treasury has little if any scope for giveaways.

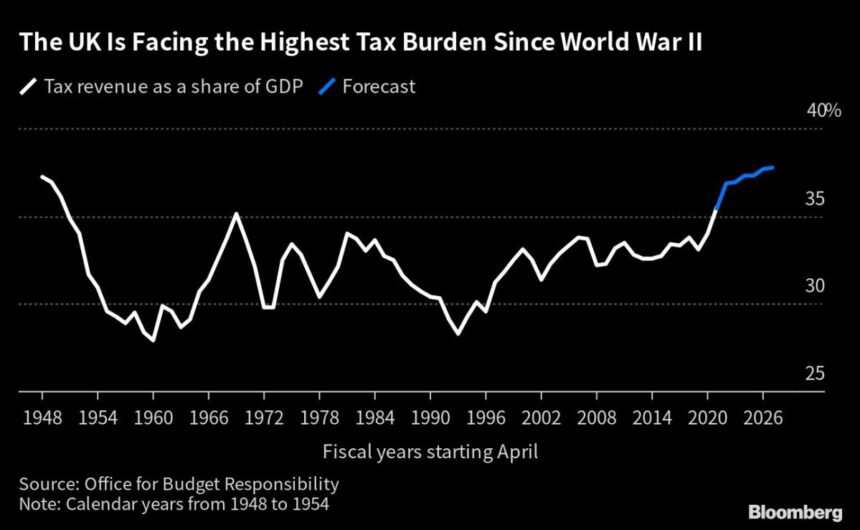

In the meantime, Sunak is building an entirely different economy to the one he talks about. At least 4 million more Britons have been dragged into income tax since 2020. Corporation tax is up from 19% to 25%. The overall UK tax burden is the highest it has been since the end of the Second World War.

The contradiction between vision and reality speaks to a country in the grip of an identity crisis, and the opposition Labour Party has seized the opportunity.

High rates are the “Tory mortgage bombshell,” Labour says. “There’s more than a touch of the 1970s about our economic situation right now,” Labour leader Keir Starmer said on Thursday, linking the current malaise with the last time the UK was the “sick man of Europe.”

As an expected election next year approaches, the question of Britain’s growth strategy will come into sharper focus.

–With assistance from Andrew Atkinson, Greg Ritchie and James Hirai.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.