Overall, consumers are financially better off in 2024 compared to last year. This is due to a combination of a resilient labour market, solid wage growth, and cooling inflationary pressures, all of which have provided relief to households’ budgets. However, despite a more positive future economic outlook, consumers across different regions remain sceptical and continue to adhere to cautious spending behaviours.

In this two-part series, we will dive into how consumers’ spending behaviours have changed since COVID-19 and how they continue to be influenced by economic anxiety. Part one will focus on how consumers across the globe have adjusted their shopping and spending habits to fit a smaller purse as their finances have taken a tumble following several lockdowns and a cost of living crisis. Continue reading this article for the first instalment in the two-part series to find out how your business and your brand can stay relevant by supporting customers in their quest to make their money stretch as far as possible.

How Are Macro-Economic Factors Impacting Consumer Spending Behaviour?

UK households have long since made changes to their spending priorities and behaviours to counteract the challenges the cost of living crisis has thrown at them. While consumer sentiment has improved somewhat in recent months due to falling inflation levels, most Brits reject the notion that the cost of living crisis is over. Therefore, improving macroeconomic conditions take time to be reflected in consumer attitudes. This is partly a reflection of ongoing difficulties caused by increased interest rates and rents, but it also points to the lasting emotional impact of the crises people have faced in recent years. Overall, consumers in the UK are adapting their day-to-day spending habits rather than making major shifts in their use of products and services. Their focus lies on extracting maximum value from their current spending, with a reluctance to cut out entire areas of expenditure. While most people spend the same in essential categories, many reduced their spending in discretionary areas such as leisure and premium food last year. Looking ahead and as finances recover, UK consumers will look to get back to spending on big-ticket and luxury items, however, there is still a strong sense of caution, and Brits are by no means going to loosen their purse strings completely. Rather, there are growing opportunities for discretionary categories, but brands will still need to work hard to convince people to part with their money through strong value messaging.

Across the pond, US consumers’ spending appetite is still elevated even after multiple years of crises. However, this doesn’t mean that buyers haven’t made changes to how they distribute their budgets. Apart from relying on more discounter retailers and private label products, US Americans have prioritised their savings in order to be prepared for what the US economy might be throwing their way in the future.

Similar to the UK, German consumers have gloomy expectations for the economy. Navigating from crisis to crisis has created fatigue among consumers, dampening their financial outlook. As a result, savvy shopping habits picked up during the height of inflation are here to stay, and reduced spending budgets force Germans to evaluate their priorities and long-term goals, such as home ownership. In opposition to this German consumers are less pessimistic when it comes to changes in their household income. One reason for this could be that they have much greater understanding and even more control over their own finances than macro issues. However, the two are intrinsically linked, and pessimistic consumer sentiment regarding the economic outlook can directly impact their financial confidence.

The Asia Pacific region has seen significant changes due to the financial impact of the COVID-19 pandemic. Many consumers in the region have experienced financial anxiety, which has led to widespread cost-cutting and loss of jobs, with unemployment rates in APAC estimated to grow even further. As a result, Chinese consumers have made cutting discretionary spending their first priority to improve their financial situation. Meanwhile, in Thailand, consumers are choosing private-label products over branded equivalents. The constant hunt for the lowest price has caused consumer loyalty to diminish in the APAC region.

Changing Consumer Spending Behaviour: How Has the Strain on Budgets Altered the Way People Shop?

The cost of living crisis has had a profound impact on the shopping habits of millions of Brits. More than ever, consumers are taking a more cautious approach, putting in extra time to make their money go as far as possible, and are going to the shops more prepared:

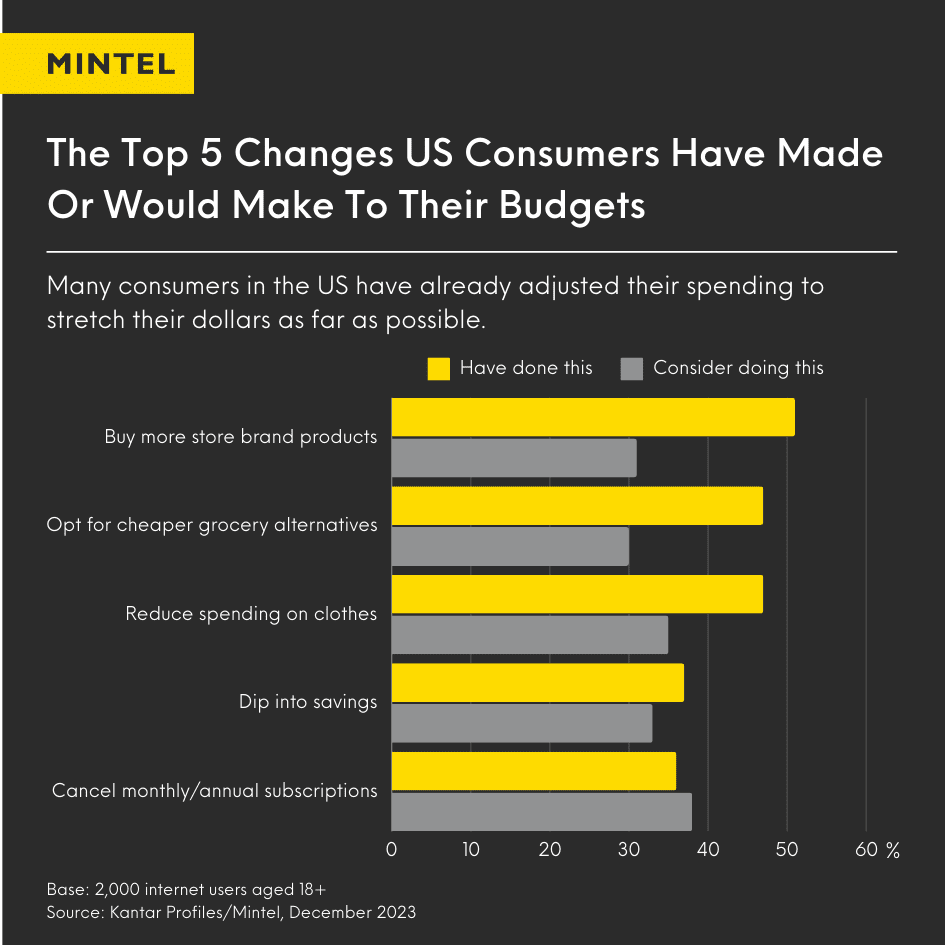

In the US, households’ optimism has steadily risen since May 2023, with half of consumers expecting to be financially better off over the course of the year. This has resulted in a notable increase in spend across categories like travel, home improvements, and big ticket items at the tail-end of 2023. This swell of spend is expected given that this period coincides with the holidays, as the shopping season tends to be full steam ahead amid the plethora of deals and discounts to boost retail sales. However, US consumers leave the shopping season behind, cheaper grocery alternatives and scaling back on spending on clothes and dining out are ways US Americans are trying to stretch their dollars.

Moreover, the second half of 2024 could cause confidence to be volatile again with the US presidential election. Despite improvement, it’s worth noting that confidence still remains well below levels seen right before the pandemic. Therefore, retailers shouldn’t expect spending to rebound at the same rate as confidence – there will be a bit of a lag effect as many consumers cautiously expand their shopping repertoires.

Savvy shopping and spending changes US consumers have or would make:

Particularly building material, garden supplies, and the furniture and home furnishing categories have seen a decline. The latter two have thrived during the pandemic as the home became a focus area, but have since experienced a slump with the outlook for furniture and home furnishings expected to continue in a similar way throughout 2024. Conversely, the health and personal care sector has seen a significant increase as consumers in the US are prioritising their health and wellness to a greater degree since COVID-19. Similarly, food services have also seen significant growth due to consumers taking advantage of being able to go out and socialise again.

German consumers remain prepared to make extensive cutbacks on their most valuable activities as they remain cautious about their economic and financial outlook. Recent crises and rising prices have brought about changes in Germans’ consumer spending habits from reduced energy use at home to increased purchases of private label products and low-cost retailers. Brands can tap into the rise of private labels by continuing to innovate in own label products. Food and drink brands in Germany responded to this, with private labels gaining a significant share of new launches in 2022.

Consumers look to second-hand clothing to save money and the environment. Although fashion remains among German consumers’ top spending categories, many will choose to cut back if they have to. Two-fifths of Germans report that money concerns have caused them to look for alternatives to buying new items. As a result, second-hand shopping is rising in popularity as a more affordable and sustainable way to shop. This has opened up new opportunities for brands to tap into resale programs, and lots of corresponding initiatives in the German fashion retail market over the last year have emerged. Since nearly three in four Germans think that buying second-hand is a good way to reduce environmental impact and nearly one in two would like to buy more second-hand products in the future, fashion brands that embrace resale and position their value with regard to sustainability will have an advantage over competitors.

For example, Zara has launched its own resale platform where customers are encouraged to buy and resell their pre-loved Zara items, and also offers repair services and a space to donate clothing. Source: zara.com/de/

In India budget-driven shoppers can be enticed to loosen their purse strings with private labels: Four in 10 consumers in India prioritise low prices when buying products and 34% seek premium private-label products. Retailers can offer value packs for private-label products to ease budget-stricken consumers, and further improve quality perceptions in their brand options to enhance value.

Furthermore, 56% of Indian consumers with a tight budget are home cooking more often instead of getting food delivered and almost half are switching to cheaper ingredients. Retailers can support their changing consumer behaviour by making cooking fun and enjoyable, instead of just a way to reduce costs. Food brands such as CooX Asia aim to foster meaningful connections with consumers by cultivating a vibrant community of home cooks and food enthusiasts.

Saving For A Rainy Day

Although savings activity was significantly reduced compared to the levels seen over the last few years and despite the challenges posed by the rising cost of living, household savings deposits in the UK continued to rise by 4% in 2022. In fact, regular savings remains among the top three consumer spending priorities with over half of Brits putting money aside for a rainy day: Only 14% of consumers have reduced their savings or pension contributions. As UK households’ economic outlook remains pessimistic, saving remains the top financial priority as Brits look to repair finances damaged by the cost of living crisis.

Similar to the UK, consumers in the US have reduced their discretionary spending and started to prioritise their savings as they came off the Christmas holidays. The intention being to be prepared to spend more again in the summer: Over two-fifths of US consumers added to their savings at the end of 2023. While the high-rate environment has been a thorn in the side of borrowers, the bright side is that the rise in Annual Percentage Yield across high-yield savings accounts, with some financial institutions even offering an APY of over 5% – present a handsome return for consumers looking to be actionable about their savings intentions.

Many German households remain cautious in spending because they fear, among other things, high subsequent payments for utility and common charges, such as gas and electricity. Consequently, and in spite of rising costs, German consumers continue to save and the savings ratio remained high in the first half of 2023. However, with less disposable income available, consumers in a worse financial situation are less likely to prioritise regular savings. Since lower-income households are hit hardest by the cost of living crisis and its aftermath, they will need more time to recover than better-off households. Brands are encouraged to reinforce support for these consumers in improving their financial resilience and reaching their savings goals. For example, by cooperating with “save now, buy later” providers like SaveStrike. This will increase brand reputation, as consumers will perceive financially responsible brands as being reputable and trustworthy.

One Does Not Fit All

There are clear gender differences in consumer responses to budgeting with women making more decisive changes to their spending habits. Over half of women in the UK have used stricter shopping lists to adhere to. Women are also significantly more likely to have made their lunch rather than bought from a food outlet, chose reduced items, and substituted for cheaper ingredients. This trend is indicative of continued gender inequalities in many households that, traditionally, see women more often responsible for household shopping. The gender pay gap is another issue impacting how women handle the high cost of living. Women continue to earn less than men on average, making them more vulnerable to the effects of high inflation. This in turn is likely to prompt greater anxiety among women, which again will prompt a bigger behavioural response.

Apart from behavioural differences based on gender, Mintel experts are also observing differences based on age. The older cohorts of Millennials and Gen Z are significantly more likely to make their own lunch rather than buying it. However, the younger cohorts within the Millennial and Gen Z target group are falling behind. A lack of skills or awareness of the savings that can be made by savvier shopping and food preparation are the reason why the youngest adults aren’t making the same money-saving changes to their meal habits as their slightly older peers. This is an opportunity for brands, particularly supermarkets, to engage with the youngest adults through affordable meal plans and to inform them of the savings they could make by meal prepping.

The extent to which consumer spending habits are changing in the US depends on US households’ financial situation. Higher-earners’ financial outlooks are naturally more positive due to them already being in a stable position. On the contrary, the lower-end income brackets displayed the highest amount of pessimism around their financial futures. The challenges for these households are aplenty, such as living on a paycheck-to-paycheck cadence, contending with higher levels of debt, and greater credit card dependency. All of these factors contribute to lower-earners having thinner financial margins, which also leads to a virtually nonexistent financial cushion to fall back on should unforeseen circumstances arise. The high rate environment of the past two years has only amplified this segment’s financial hardships, primarily due to the rise across credit card APRs. Given that low-earners have a higher likelihood of revolving their credit cards, the interest they accrue on their monthly balances has only grown larger, piling on to the mountain of financial challenges they are wrestling with. Financial institutions, especially those that serve subprime credit bands, should establish contact with these struggling customers and offer debt relief solutions and money-management counselling to put them on the road towards financial recovery.

Best Egg has published an informational piece on setting up a successful debt reduction plan for consumers in financially strained circumstances and is offering them a tool to regain control over their finances. Source: bestegg.com

A Future Outlook on Changing Consumer Behaviour with Mintel

Overall, consumers’ financial outlook is expected to be more positive, however, years of uncertainties and crises have left consumers across the globe feeling deflated and sceptical. The more positive financial outlook, therefore, may not be reflected in consumer shopping habits.

Nevertheless, there are opportunities for businesses to encourage consumer spending if they focus on the messaging around their products. Added value, such as sustainability claims, longevity, and more, are key to enticing consumers to part with their hard-earned money. To find out what you can do to make your brand and products stand out stay tuned for part two of Mintel’s Guide to Consumer Spending Habits.

For all of our Consumers and Trends Market Research visit our Mintel Store here. Or sign up to Mintel Spotlight below to receive fresh and free market insights, delivered directly to your inbox.

Sign up to Spotlight