Receive free NatWest Group updates

We’ll send you a myFT Daily Digest email rounding up the latest NatWest Group news every morning.

NatWest shareholders have ramped up pressure on chair Sir Howard Davies to step down for mishandling the fallout from the closure of Nigel Farage’s bank account.

“He’s clearly not in charge,” said a top-20 investor on Wednesday. “Banking is about trust and confidence. That’s sacrosanct and starts with the tone from the top.”

NatWest chief executive Dame Alison Rose stepped down in the early hours of Wednesday morning after admitting to misleading a BBC journalist about the closure of the former UK Independence party leader’s account at its private bank, Coutts.

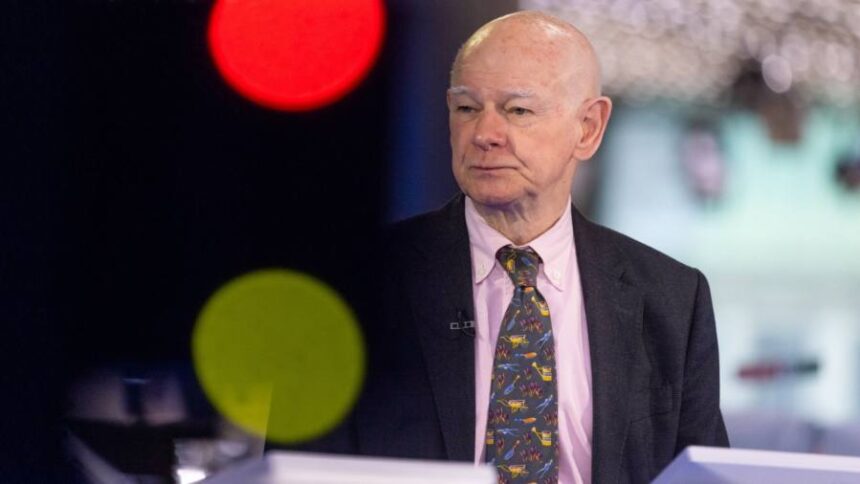

The announcement came only seven hours after Davies, who has been chair of NatWest since 2015 and is nearing the end of his tenure, said that Rose retained the “full confidence” of the board despite her confession. He praised her as an “outstanding leader of the institution” and said that it was “clearly in the interest of all the bank’s shareholders and customers that she continues in post”.

“My suspicion is that he will end up going, but probably shouldn’t have to,” said a second top-20 investor, questioning whether he had cleared the statement of support with the government before its release.

According to a person briefed on the process, Davies did consult the government and regulators on the bank’s stance before releasing the statement on Tuesday.

NatWest shares were down more than 3 per cent in early afternoon trading, making them the biggest faller on the FTSE 100 and extending their decline to almost 11 per cent this year.

The drop comes despite the boost in earnings the bank has received from rising interest rates. NatWest reports its second-quarter earnings on Friday. The government owns 38.69 per cent of the UK lender, down from a peak of 71 per cent in 2016.

On Wednesday, Farage said the bank should “put in place very quickly a new interim board”. He has also called for Coutts chief executive Peter Flavel to go.

Craig Mackinlay, a Conservative MP, called for the resignation of Davies as well as Flavel. “Both need to bear due responsibility for this unsavoury mess,” he told the Financial Times.

“The Farage saga with the NatWest group is both shameful and sinister,” he said. “Perhaps it is time for a more substantial clean-up of the board.”

David Davis, a former cabinet minister, said Flavel’s future should be in doubt in the wake of Rose’s resignation. “I don’t like aiming for the juniors, the person who should pay is the person with the biggest pay packet,” he said.

The Conservative MP said the NatWest chair, Davies, had a questionable record, adding: “I would certainly not renew his contract next year, put it that way. I would look at that if I was a minister.”

Despite the pressure from shareholders and some MPs, senior government figures suggested that Davies’s position was more secure than Rose’s had been, given that she quit after admitting she personally leaked customer information in potential breach of data confidentiality laws.

“The issue was Alison — she briefed a journalist incorrect information,” said one Treasury figure.

“He always wants a revolution,” said one minister of Farage’s demands, noting that Davies is already approaching the end of his tenure.

Davies, an economist who steered the former Royal Bank of Scotland through a restructuring and return to profitability, said in April he would step down by July 2024, and the bank has already begun searching for his successor. He is approaching nine years as chair, which is the recommended limit under UK corporate governance rules.

The first shareholder said the Farage episode “has taken far too long and Nigel Farage had to campaign for the truth. That’s wrong. What about people who don’t have his platform? The board must have known the reason for his being excluded from Coutts.”

NatWest declined to comment. Davies did not respond to a request for comment.