Now that summer’s coming to an end, that means it’s time to pull out your scarves, grab a pumpkin spice latte, and reassess your tech stocks. This Yahoo Finance series helps you decide what to do with your shares of the biggest names in tech — Apple, Alphabet, Amazon, Microsoft, Meta, Nvidia, and Tesla — known as the Magnificent Seven. Up first is this year’s hottest tech stock, chipmaker Nvidia.

Nvidia stock (NVDA) just hit an all-time high, and its historic year isn’t over yet. But how far can the company’s AI-fueled mega-growth really go?

After soaring over 230% year to date and entering the trillion-dollar club alongside Microsoft (MSFT), Amazon (AMZN), Apple (AAPL), and Alphabet (GOOGL, GOOG), the company has become the name to beat in the AI boom. And it may have more room to run, Interactive Brokers chief strategist Steve Sosnick said.

“This stock has more or less powered an entire theme of investing,” Sosnick told Yahoo Finance. “AI as a concept is not new. ChatGPT is what made AI mainstream and brought it to a lot of laypeople’s attention. So as this gold rush started, Nvidia really fits the ‘pick and shovel’ metaphor.”

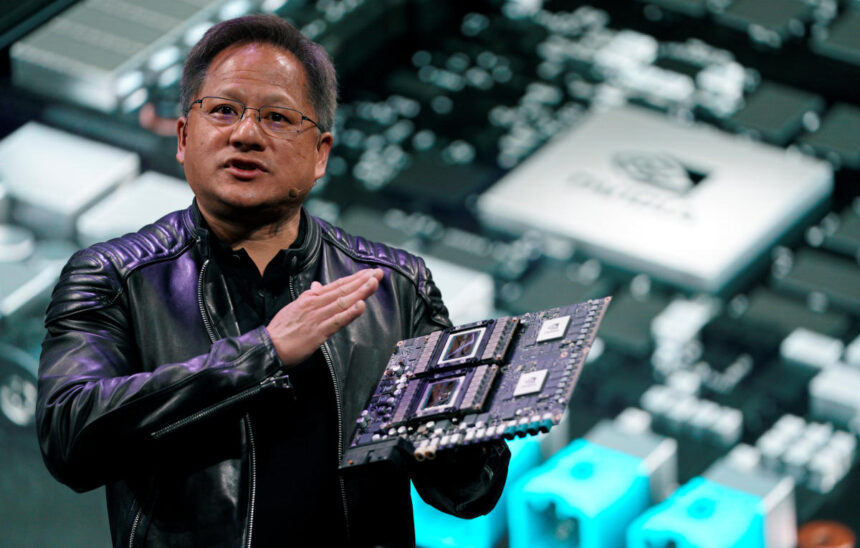

Nvidia’s competitive moat

Nvidia is viewed as boasting the pole position in the AI space due to its H100 chips that power OpenAI’s ChatGPT platform and other budding tech applications. The company has also inked high-profile generative AI chip deals with ServiceNow (NOW) and Snowflake (SNOW).

The strong demand triggered a material upward reset in Nvidia’s guidance on May 24 that stunned the broader market. Nvidia’s market cap exploded by $184 billion the next day as investors raced to get a piece of a rapid growth story.

Just a week ago, Nvidia once again surprised everyone with better-than-expected guidance and a new $25 billion stock buyback.

When it comes to those H100 AI chips, it’s not just hype, since Nvidia is in a class all its own — for now, at least, Raymond James analyst Srini Pajjuri said.

“They’re the only game in town in terms of AI processing right now,” he told Yahoo Finance. “Demand and supply at some point will come into balance, but this is still a growing market.”

The company also has a solid competitive moat around the AI chip business, though it will likely get chipped away over time. The question is by how much? That will determine how high Nvidia’s valuation can go over time, pros say.

The company’s moat in the public cloud — in which cloud resources use a shared, public infrastructure — is especially strong and supportive of Nvidia’s valuation.

“In the public cloud, it’s going to be really difficult to compete with them because of the ecosystem they’ve built,” Pajjuri said. “I’m not saying Nvidia’s moat is as strong as the iPhone, but it’s the strongest out there when it comes to AI, and that’s especially in public cloud.”

Competition will be coming down the pike nonetheless, especially as Nvidia’s offerings are expensive, and customers will inevitably look for cheaper alternatives. Having a short supply is also a key issue up for debate on the Street.

AMD (AMD) has already been moving to challenge Nvidia. Competition may even come from customers themselves as they look to build their own AI chips. And some of tech’s biggest names increasingly have been moving to build their own chips in recent years, including Amazon and Apple.

What should you do with Nvidia stock?

Clearly, Nvidia stock is very hot right now.

And a cooldown in the stock isn’t imminent, experts who follow Nvidia told Yahoo Finance.

“We still like the story, demand is still very strong, and supply is constrained,” Pajjuri said.

Looking ahead, experts believe there are between two and three more quarters of sizable wins in the AI space and strong EPS growth for Nvidia.

“I still do believe fundamentals matter,” Sosnick said. “On one hand, I can’t think of a company that’s growing faster, but also a lot of that growth is priced in.”

At the end of the day, Wall Street overwhelmingly says buy the stock. According to Bloomberg, analysts’ recommendations currently come in at 56 Buys, four Holds, and zero Sells.

Allie Garfinkle is a Senior Tech Reporter at Yahoo Finance. Follow her on Twitter at @agarfinks and on LinkedIn.

Click here for the latest technology news

Read the latest financial and business news from Yahoo Finance