Nvidia (NVDA), a giant in data centers and gaming, continues to sizzle. The chip giant is seen as one of the biggest winners of the AI boom. Is Nvidia stock a buy right now?

X

Semiconductor, AI News

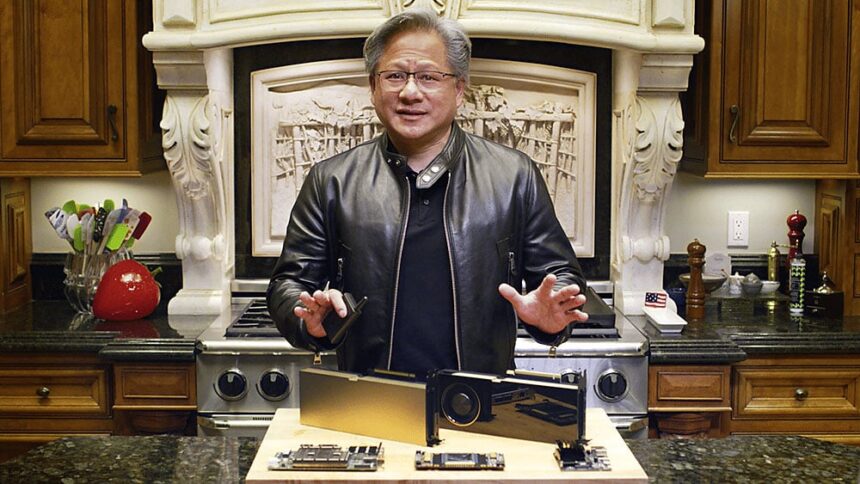

On May 30, Nvidia Chief Executive Jensen Huang announced a new supercomputer, software and services for generative AI (artificial intelligence). Generative AI can create content, including written articles, from simple descriptive phrases by analyzing and digesting vast amounts of data. It can also write computer programming code.

For its latest quarter, graphics-chip maker Nvidia crushed Wall Street’s targets on record data-center sales. Production is ramping up to meet huge demand for AI technology, CEO Huang said.

Nvidia is a leader in AI chips. In the tech industry’s fierce battle for AI dominance, the advanced chips needed for generative AI, such as the ChatGPT chatbot, are key.

For those looking for top large-cap stocks to buy now, here’s a dive into NVDA stock.

Nvidia Stock Technical Analysis

The chip stock is extended from a 419.38 buy point, meaning shares are not in buy range. The entry from a three-weeks-tight pattern had offered a place for existing investors to add a few more shares.

Shares pegged a 52-week high of 480.40 in intraday trading on July 14, but then closed 1.1% lower.

Nvidia stock rocketed in May on blowout earnings and strong guidance. NVDA remains on the IBD Leaderboard after joining that prestigious list in February on an earnings gap-up.

Year to date, Nvidia stock has skyrocketed 211%, after crashing in 2022. So far, the chip giant continues to hold up well.

NVDA earns an IBD Composite Rating of 99, the highest possible score. In other words, Nvidia stock is in the top 1% of all stocks in terms of technical and fundamental metrics.

Investors generally should focus on stocks with Comp Ratings of 90 or even 95 and above. Nvidia stock often earns a spot on the IBD 50, Big Cap 20 and Sector Leaders lists.

The relative strength line is striking fresh highs, the IBD MarketSmith charts show. A rising RS line means that a stock is outperforming the S&P 500. It is the blue line in the chart shown.

The IBD Stock Checkup tool shows that NVDA carries a Relative Strength Rating of 99. That means it has outperformed 99% of all other stocks over the past year.

The iShares PHLX Semiconductor ETF (SOXX) holds both Nvidia stock and AMD stock.

IBD Live: A New Tool For Daily Stock Market Analysis

Nvidia Earnings

Nvidia’s EPS Rating is 68 out of 99 and its SMR Rating is a B, on a scale of A to a worst E. The EPS rating compares a company’s earnings growth to other stocks. Its SMR Rating gauges sales growth, profit margins and return on equity.

On May 24, the chip giant delivered a big beat-and-raise report. The Nvidia earnings report included a bullish, AI-fueled sales forecast.

The Santa Clara, Calif.-based company earned $1.09 a share on sales of $7.19 billion in the quarter ended April 30. Year over year, Nvidia earnings dropped 20% while sales fell 13%. But the results easily outpaced Wall Street’s expectations.

In Q1, data-center sales rose 14% to $4.28 billion. Gaming-chip sales fell 38% to $2.24 billion.

Analysts expect Nvidia earnings to rebound 135% in fiscal 2024, on a 60% sales gain. Last year, Nvidia earnings fell 25%.

Its next quarterly report is due Aug. 23.

Out of 49 analysts covering NVDA stock, 42 rate it a buy. Six have a hold and one has a sell, according to FactSet.

Looking For The Next Big Stock Market Winners? Start With These 3 Steps

NVDA Backstory, Rivals

The fabless chipmaker pioneered graphics processing units, or GPUs, to make video games more realistic. It’s expanding in AI chips, used in supercomputers, data centers and drug development.

Nvidia’s GPUs act as accelerators for central processing units, or CPUs, made by other companies. It’s working on “supercomputers” combining its own CPUs and GPUs.

In addition, Nvidia chips are used for Bitcoin mining and self-driving electric cars.

Nvidia has made a big push into metaverse applications.

Fabless chip stocks include Qualcomm (QCOM), Broadcom (AVGO) and Monolithic Power Systems (MPWR).

Currently, the fabless group ranks No. 3 out of 197 industry groups. Fabless companies design the hardware while outsourcing the manufacturing to a third-party firm.

For the best returns, investors should focus on companies that are leading the market and their own industry group.

Is Nvidia Stock A Buy?

On a fundamental level, Nvidia earnings are expected to return to growth. They should more than double this fiscal year, driven by booming chip sales for data centers and artificial intelligence.

The fabless chipmaker is expanding in other growth areas such as automated electric cars and cloud gaming as well. The adoption of the metaverse and cryptocurrencies could further stoke demand for Nvidia chips.

However, macroeconomic uncertainties and risk of global recession linger.

NVDA stock has staged a massive comeback, more than tripling in 2023 so far. Shares cleared a 419.38 three-week-tight entry in June but have climbed above a proper buy zone.

Nvidia’s latest supercomputer news and earnings have further highlighted its AI leadership.

Bottom line: Nvidia stock is not a buy. As a leading chip company with exposure to top end-markets, Nvidia is always one to watch.

Check out IBD Stock Lists and other IBD content to find dozens of the best stocks to buy or watch.

YOU MAY ALSO LIKE:

Is AMD Stock A Buy?

See The Best Stocks To Buy And Watch

Catch The Next Big Winning Stock With MarketSmith

Join IBD Live And Learn Top Chart-Reading And Trading Techniques From The Pros