A photo of bears waiting for a market crash:

Seriously, the story rocking boats yesterday was this ?one. A Mexican journalist claims he found two “non-human” corpses in Peru in 2017. Says they’re around 1,000 years old.

Ha! There’s just so much here to unpack. The best though are the comments on social media.

However, ahem. This is not the place to dive into those murky waters. Instead, let’s consider the market swamp today.

Several interesting eddies are worth consideration…

Perhaps one of the fastest IPOs I’ve ever seen, the company’s offering price is $51 per share. A bunch of “cornerstone investors” say they’re interested in buying up an aggregate of $735 million of the ADSs offered at that $51 price. These include AMD, Apple, Google, Intel, Nvidia and Samsung, among others.

As always, this could go one of two ways.

It could be a lackluster IPO.

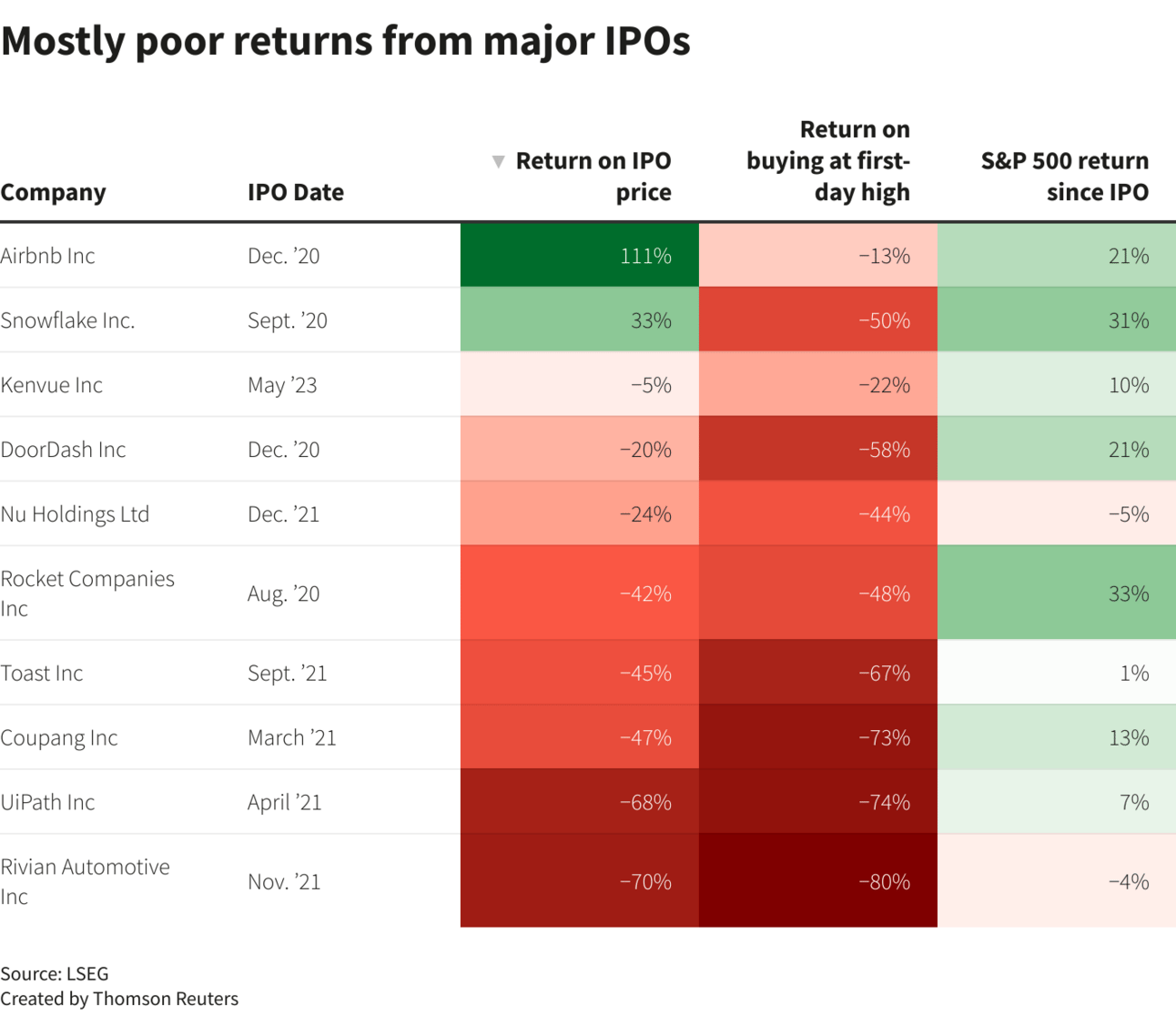

Odds are not on ARM’s side. A Nasdaq analysis of companies that have gone public since the 1980s showed that the success rate is super low – like 20%. The remaining 80% end up being unprofitable when they make their debut on a stock exchange.

In fact, this whole offering seems like a sham. It’s an old company that was once public, was taken private, and is now being peddled back to investors at the highest price possible. This could destroy retail traders and investors who think they’re “lucky” to get in on this IPO.

My bet is this will be a big thumbs down ? over the next few months.

However, there is, of course, the possibility that the stock could rocket to the moon ?.

While I don’t like the long-term prospects here, when it comes to opportunistic trading… that’s a different story.

ARM is roughly 10x oversubscribed, from what I read, which signals a very strong demand on opening day.

If I can scoop up some shares near the IPO price today, I may do so. I think this has 10-20% potential just today.

I don’t want to hold it overnight, but this will definitely be on the radar of day traders and I expect this to get a pop today at least.

If that happens, it will bode well for the market. I could even see the markets making new highs for the year in the next few weeks, if ARM is a success.

I might take a flyer on a quick trade like ARM, but the majority of my trading is focused on finding trades in strong companies.

Adobe and Lennar should be interesting to watch into tomorrow. Both report earnings after the close today.

Investors expect ADBE to deliver record revenue of $4.86 billion in the third quarter. This is one of my favorite tech stocks, so I will be rooting for them, but not trading the stock.

My game is to always wait for earnings to come out, and then play the move that follows.

On the other hand, the market is not so optimistic about LEN. Expectations are the earnings per share for the quarter will decrease by 33% year-over-year.

As for Alpha Hunter, I have already booked a 67% win on my bull put in UVXY. I have five other trades open for the month as I work my way towards my $10,000 goal. ?

I have a few trades that I am planning on locking in some serious gains tomorrow. I hope the market doesn’t spoil my plans!

Alpha Hunter members have had the chance to see me open and close every single trade along my $10,000 mission for the last two months since I started it.

So far, they have gotten to see me book over $20,000 in profits. Not a bad journey so far!

In the live training I invited you to this week, I explained yesterday why I love trading iron condors, as one of my favorite types of trades.

They offer so much more room to profit when done right.

Either I succeed… in which case I think you will gain confidence in your trading through the lessons I’ll impart during this challenge.

Or, I’ll fail… and you can laugh and poke fun at me (and you’ll still learn a lot!).

Both are pretty good deals, I’d say.

So as always, here’s to YOUR success,

P.S. I started using a new charting software today, called Blackbox. It’s so much more user-friendly than anything I’ve used before. I am giving up on using StockCharts after nearly 20 years and making the move here. If you’d like to enjoy powerful, uncomplicated charting as well, click here. Just so you know, we have an affiliate relationship with Blackbox Stocks and earn a small percentage when you sign up – Don’t let that stop you though!

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.