Rmcarvalho

REITs showed slight gains ahead of the Q3 earnings season.

Notably, Citi reiterated its overweight stance on the real estate sector earlier this month, citing that fundamentals look positive and that stock valuations are “compelling.”

“We continue to like the optionality the sector provides should rising rate fears abate. Fundamentals remain generally solid per earnings and margin trends,” Citi stated in a recent investor note.

The financial institution gave a neutral assessment of sentiment in the sector, saying that short interest has ticked lower over the summer. It also highlighted that the sector’s relative performance momentum is weak and that RSI is now oversold.

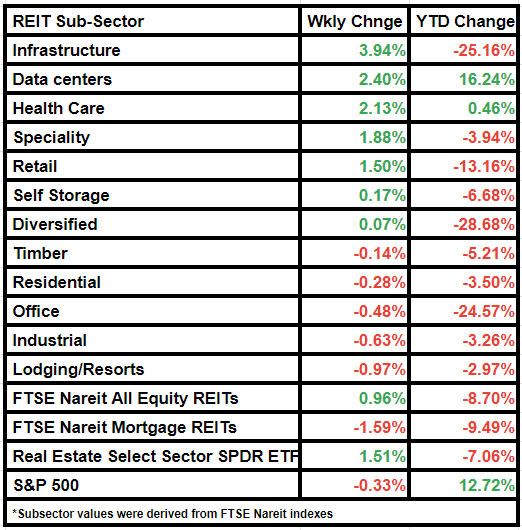

For the week ended Oct. 13, the FTSE Nareit All Equity REITs index increased by 0.96%, while the Dow Jones Equity All REIT Total Return Index rose by 0.91%.

Comparatively, the broader Real Estate Select Sector SPDR ETF was up by 1.51%, and mortgage REITs declined by 1.59% from last week.

Mortgage REIT Hannon Armstrong Sustainable Infrastructure Capital (HASI), office REIT Office Properties Income Trust (OPI) and health care REIT Ventas (VTR) were among the biggest gainers of the week.

Retail REIT Wheeler Real Estate Investment Trust (WHLR) was among the biggest losers.

Infrastructure gained the most among subsectors, having increased by 3.94% from last week.

Hotel REITs were the biggest losers of the week. The subsector fell by 0.97%. Sentiments are negative surrounding the subsector, but has gotten less bearish recently as a higher-for-longer interest rate outlook has a less significant impact on hotel fundamentals/valuations, according to a recent research note by Baird Research.

Industrial followed in terms of weekly performance. The sector faces higher vacancies, and rent growth is expected to continue to moderate into 2023-end and into 2024. The slowing has been reflected in the REITs, with the stocks down 2.2% YTD and 7.6% in the last month, Baird Research said in another report.

Here is a look at the subsector performance this week: