Receive free Currencies updates

We’ll send you a myFT Daily Digest email rounding up the latest Currencies news every morning.

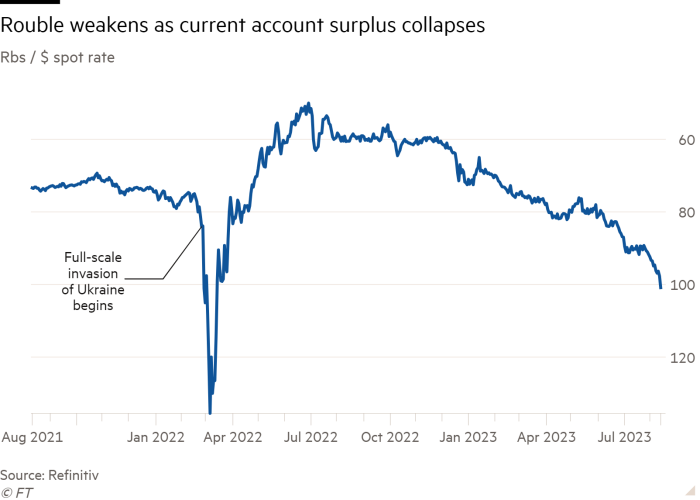

The rouble has fallen to a 16-month low against the dollar as a surge in Russian military spending and a collapse in export revenues add pressure to a currency suffering under western sanctions and an escalation of capital outflows.

Russia’s currency has lost about 25 per cent of its value this year and weakened past 100 roubles to the dollar in early trading on Monday as the impact of the war with Ukraine bites. The decline has more than offset the rouble’s rise last year when Russia’s initial invasion of Ukraine was followed by a sharp increase in oil and gas prices.

The drop has accelerated in recent weeks, raising economic pressure on Moscow after western sanctions limited capital inflows and European countries weaned themselves off Russia’s energy supplies, reducing the revenues it receives from oil sales.

The domestic economy has been boosted by government spending on defence and social commitments such as the “coffin payments” received by families of soldiers who have died on the battlefield in Ukraine. But this has also raised the budget deficit, pushing the currency lower.

The surge in spending has driven a 20 per cent increase in annual imports in the first half of this year.

“Very little currency comes into the country, so a currency famine has formed,” said Vladimir Milov, a former deputy energy minister who now opposes the Kremlin from exile.

“Imports have now recovered to prewar levels, only now we import all consumer goods and manufactured goods from China, Turkey, Central Asia and the Emirates, and not from the West. You still have to pay for it in some currency but no one wants roubles.”

A steep cut in interest rates last year put further downward pressure on the rouble; the Central Bank of the Russian Federation has slashed its rate from 20 to 7.5 per cent in less than a year.

“Government spending serves as a direct conduit for boosting imports, with a short lag,” said Natalia Lavrova, senior economist at BCS Global Markets. “A loose monetary policy does the same with a longer lag.”

In a rare case of criticism within the system following the invasion, Russian propaganda rushed to blame the CBR, whose head Elvira Nabiullina has been targeted by Russia’s hardliners for being “too liberal” with the rouble’s depreciation.

“What is happening in this country!? How did this exchange rate come about? Eventually, this will lead to a rise in consumer prices, and it will coincide with the election campaign,” said Vladimir Solovyov, one of Russia’s best-known state TV presenters, referring to the Russian presidential election next March.

Trade flows have become the driving force behind movements in the rouble after foreign trading of the currency dried up last spring. According to official figures published last week, Russia’s current account surplus — roughly the difference between exports and imports — fell by 85 per cent in the first seven months of this year compared with the same period in 2022.

Pressure on the current account threatens to weaken the currency further and stoke inflation as the cost of imports rise. Sofya Donets, chief Russia economist at Renaissance Capital, a Moscow investment bank, said the rouble “tends to be stable when the current account surplus is close to $5bn and above.” In July, the surplus fell to $1.8bn.

The fall last week prompted Russia’s central bank to suspend a budget rule under which it buys or sells foreign currency from its sovereign wealth funds when oil and gas revenues are above or below a certain level.

However there is a glimmer of hope for Moscow. Revenues from Russia’s main exports, oil and gas, fell by over 40 per cent in the first seven months of the year compared with 2022 as embargoes and a G7-imposed price cap pushed down prices. But in July they began to rebound, exceeding Rbs800bn for the first time since those measures took effect.

Economists said the suspension of the budget rule would remove an incentive for rouble weakness as the impact of recent weeks’ higher oil prices feeds through to revenues.

Additional reporting by Hudson Lockett in Hong Kong