This blog post is co-authored by Sohm Gough.

Small and medium-size businesses (SMBs) have been battered over the past three years by the continuing headwinds of inflation, supply chain interruptions, macroeconomic uncertainty, and disruptive technologies that threaten market upheaval. In these unrelenting times, SMB owners and operators are hungry for capital, useful financial products, and digital services that help them run and grow their businesses. Our newly published research, The State Of Small Business Banking In The US, 2023, reveals that SMB owners and operators are:

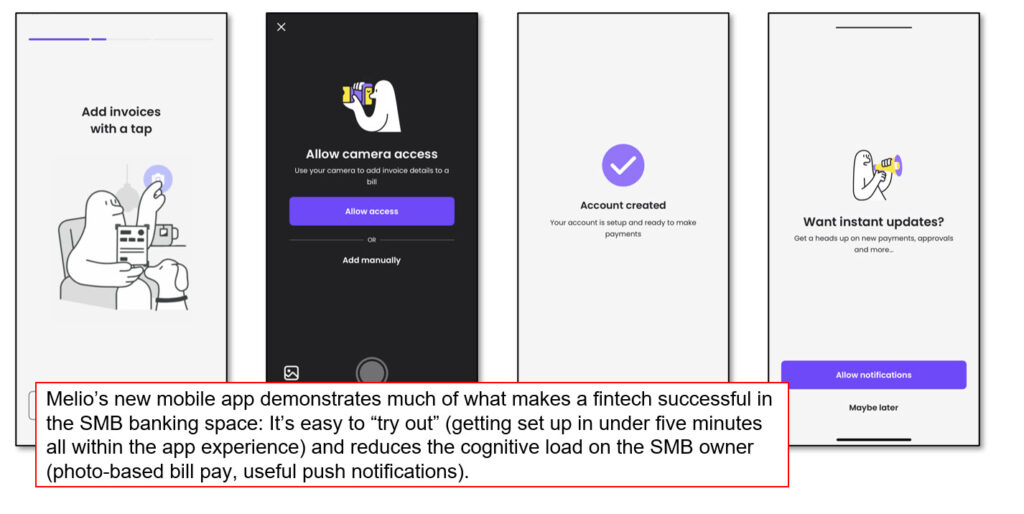

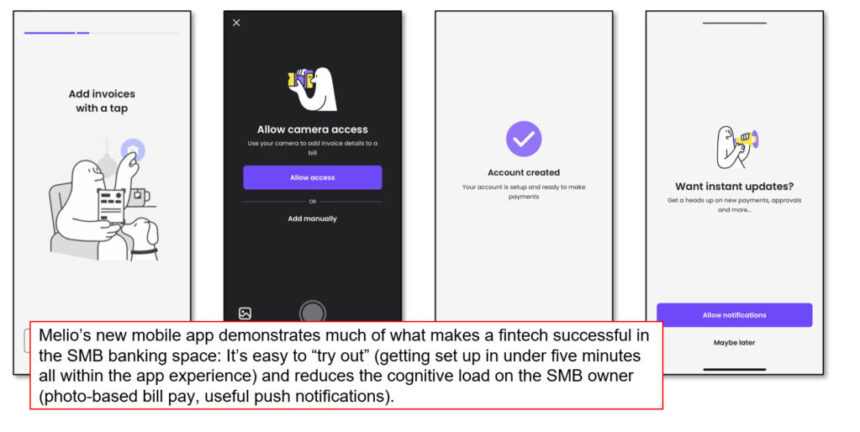

- More mobile than ever. Seventy percent of US SMB owners use mobile banking for their business at least once a month (or even more frequently). Much of this mobile banking involves informational activities: For example, 80% of US SMB owners use mobile banking apps to check business account balances at least monthly. But digital business banking now goes beyond informational tasks: 71% use mobile banking apps to pay business bills at least monthly, and 65% use them to transfer money. Leading firms recognize the primacy of mobile for SMB owners and design accordingly: Earlier this year, five-year-old fintech Melio launched a new payments and invoicing app for small and micro businesses (see screenshots below).

- Increasingly willing to try new stuff — including digital products from fintechs. Traditional financial institutions (TradFis) must grapple with the fact that SMB owners have a growing appetite for offerings from up-and-coming fintech brands. In fact, two-thirds of SMB owners in the US are willing to use a fintech company for one or more financial product or service. SMBs’ enthusiasm for fintech offerings is most pronounced in the categories of payments, deposit products, and card and lending products. Bottom line: TradFis need to watch their backs (and sides and fronts) in the small business banking space.

But the shifts and evolutions in SMB banking are not just threats for incumbent banks and other TradFis — these are also massive opportunities to innovate and drive growth. To do that, your strategy must emphasize a digital-first approach that is dynamic and creative. Ecosystems, relationship models, and a digital-first mindset are all necessary for future success in the SMB banking space.

You’ll find many more of our insights in our research report. If you are a Forrester client, we encourage you to read The State Of Small Business Banking In The US, 2023 to get a better understanding of how to better serve SMBs and the trends that are fundamentally reshaping this space.

[Image: Founded in 2018, Melio launched a new app in May 2023 for SMB owners.]