The S&P 500 (SP500) on Friday rose 0.82% for the week to close at 4,405.72 points, posting gains in three out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) advanced 0.79% for the week.

The benchmark index snapped a three-week losing streak, helped by a rebound in technology stocks with chip giant Nvidia (NVDA) notching a record high on Thursday. Concerns over higher interest rates for longer were tempered after Federal Reserve chair Jerome Powell largely stuck to a message of data-dependency with a bias towards hikes at the Jackson Hole Symposium.

Powell’s speech at the event in Wyoming was seen as the main event of the week, with market participants closely looking out for further clues on future monetary policy actions. The Fed chief’s remarks were eventually seen as being free of surprises, with Powell reaffirming a data-dependent approach and saying that policymakers at upcoming meetings would “proceed carefully” while assessing incoming economic data.

“Powell reiterated ‘more hikes are possible,’ implicitly making near-term cuts (1H24) more remote. He also adamantly kept 2% the inflation target (…2% is and will continue to be {clears throat} our inflation target…), pushing back on some who want a more flexible inflation goal. That said, Powell maintained maximum flexibility,” Mike Skordeles, head of U.S. economics at Truist, told Seeking Alpha.

This week’s gains were also helped by investors jumping back into growth sectors, with Technology topping the gainers. After three straight weeks of losses, the sector resumed its yearly climb, largely powered by a huge runup in Nvidia (NVDA) ahead of its highly anticipated results on Wednesday. Shares of the chip giant surged to an all-time peak of $502.66 on Thursday after another blowout quarter and a “guidance for the ages.”

Also helping equities this week was a stabilization of sorts in the fixed-income markets, as a recent relentless bond sell-off finally eased up somewhat, at least in the longer-end yields. The 10-year yield (US10Y) was down 2 basis points for the week. The shorter-end 2-year yield (US2Y) – which is more sensitive to imminent rate actions – was up 14 basis points for the week.

See how Treasury yields have done across the curve at the Seeking Alpha bond page.

Turning to this week’s economic calendar, data on housing and the industry pointed to signs that the economy was cooling at quite a significant pace. Long-term mortgage rates reached their highest levels since 2001, and the upward pressure on them is likely to continue, according to a survey by government-backed mortgage finance agency Freddie Mac (OTCQB:FMCC). That reflected in mortgage applications, which fell to their lowest level in nearly 30 years, and a greater-than-expected fall in existing home sales.

Moreover, data on Wednesday showed only a fractional increase in output across the private sector in August. On Thursday, durable goods orders for July slid much more than anticipated.

“Economic data released last week lifted hopes for a soft landing. In particular, an upside surprise to retail sales suggests that consumers possess a seemingly unshakable resolve, especially now that they are riding the tailwinds of receding inflation. Data on balance this week brought expectations back down to Earth, revealing that the economy does seem to be gradually losing momentum,” Wells Fargo’s Economics Group said in a note.

“Next week will be a busy one for U.S. data releases, with labor market and inflation indicators in the spotlight. The jobs report on Friday will be the key event and the last such release before the Fed’s September 20th meeting … Prior to the Friday report, investors will be focused on JOLTS (Tuesday) and ADP (Wednesday) data,” Deutsche Bank’s Galina Pozdnyakova said.

Turning to the weekly performance of the S&P 500 (SP500) sectors, seven ended in the green, with Technology posting an outsized gain of more than 2.5%. Fellow heavyweight growth sectors Consumer Discretionary and Communication Services rounded out the top three. Energy and Consumer Staples topped the four losers. See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from August 18 close to August 25 close:

#1: Information Technology +2.57%, and the Technology Select Sector SPDR ETF (XLK) +2.27%.

#2: Consumer Discretionary +1.13%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +1.23%.

#3: Communication Services +0.98%, and the Communication Services Select Sector SPDR Fund (XLC) +0.46%.

#4: Real Estate +0.88%, and the Real Estate Select Sector SPDR ETF (XLRE) +0.72%.

#5: Industrials +0.28%, and the Industrial Select Sector SPDR ETF (XLI) +0.28%.

#6: Utilities +0.26%, and the Utilities Select Sector SPDR ETF (XLU) +0.22%.

#7: Financials +0.05%, and the Financial Select Sector SPDR ETF (XLF) +0.03%.

#8: Materials -0.04%, and the Materials Select Sector SPDR ETF (XLB) -0.04%.

#9: Health Care -0.14%, and the Health Care Select Sector SPDR ETF (XLV) -0.09%.

#10: Consumer Staples -0.76%, and the Consumer Staples Select Sector SPDR ETF (XLP) -0.82%.

#11: Energy -1.37%, and the Energy Select Sector SPDR ETF (XLE) -1.37%.

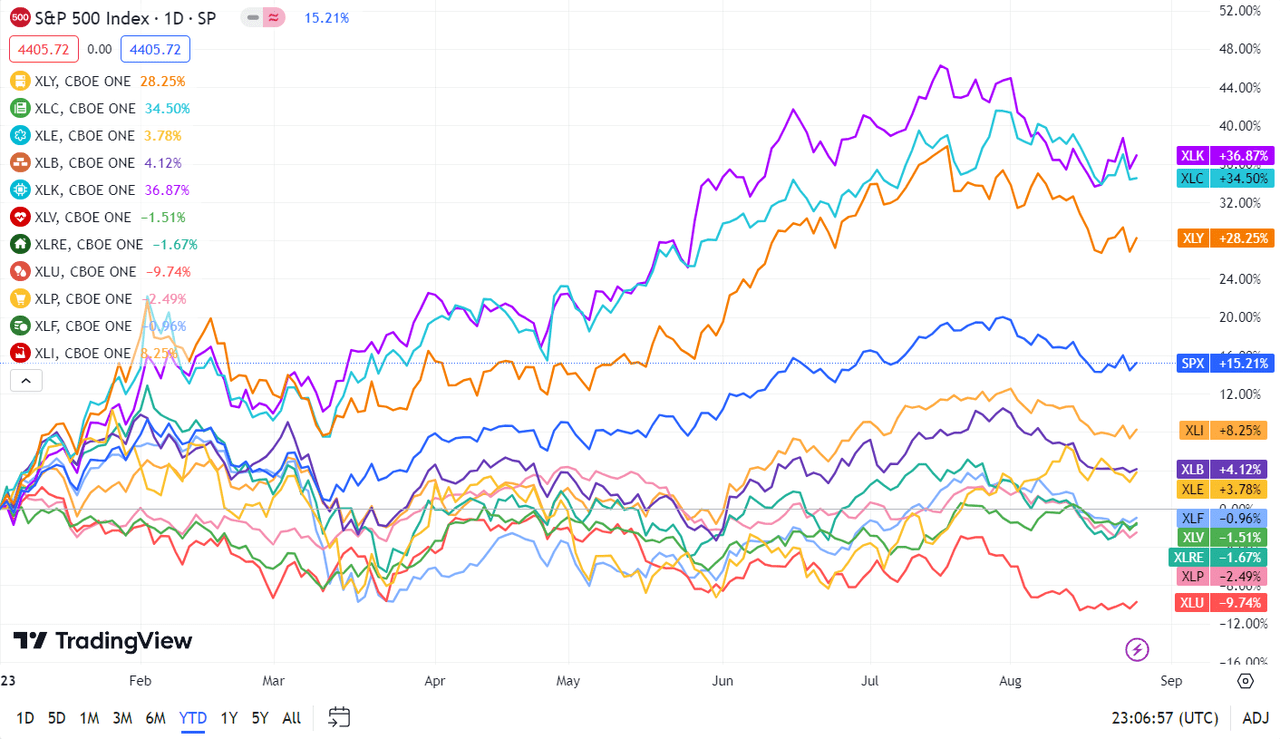

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.