The S&P 500 (SP500) on Friday slipped 0.16% for the week to close at 4,450.31 points, posting gains in three out of five sessions. Its accompanying SPDR S&P 500 Trust ETF (NYSEARCA:SPY) retreated 0.48% for the week.

The benchmark index notched a second straight negative week, though losses were small as investors digested a slew of data on inflation and the economy that failed to dent market expectations of no rate hike at the Federal Reserve’s monetary policy committee meeting next week.

The consumer price index (CPI) and producer price index (PPI) reports on Wednesday and Thursday, respectively, came in slightly hotter than anticipated, with both headline numbers accelerating on a M/M basis. Retail sales data showed a similar trend. All three indicators were mainly driven by energy and gas. On a core basis – which excludes food and energy prices – CPI rose fractionally on a M/M basis, while PPI actually moderated and so did retail sales.

Other economic data during the week hinted at strength in the manufacturing and industrial sectors, with Empire State’s gauge of manufacturing surprising to the upside and U.S. industrial production rising more than anticipated. Meanwhile, the University of Michigan’s reading of consumer sentiment slipped, though year-ahead inflation expectations moderated.

“While interest rates remain an important factor for markets, we believe markets have begun to refocus on economic growth to sustain this market rally. In other words, good news on economic data is good news for markets. Over the past 12 months, good economic news was bad news for markets as rates moved higher,” King Lip, chief strategist at BakerAvenue Wealth Management, told Seeking Alpha.

The inflation data and other indicators this week has done little to change market expectations in terms of the upcoming rate decision. According to the CME FedWatch tool, markets are now pricing in a 99% probability that the central bank’s monetary policy committee will hold interest rates steady. In fact, markets believe the Fed will hold rates steady through to the end of the year, hinting that the overall consensus seems to be that policymakers have reached the end of their tightening cycle. The Fed will also release its updated dot plot of economic and rate projections.

“We expect the FOMC will leave policy rates on hold next week. The post-meeting statement will likely leave intact the hawkish bias in the forward guidance that effectively has been in the statement since the May meeting, referencing ‘the extent of additional policy firming that may be appropriate.’ We believe the median dot for this year will show one additional hike, though think there’s a good chance the median could show no further hikes,” JPMorgan’s Michael Feroli said in a preview note.

“On the rate decision, a fair bit of intermeeting Fed rhetoric hinted at no change at next week’s meeting. The market took the cue and neither Fed speakers nor the usual press go-betweens have done anything to change the expectation of no move,” Feroli added.

Next week will be a big one for central banks in general, with the Bank of England and the Bank of Japan also issuing rate decisions. Yesterday, the European Central Bank delivered a tenth consecutive rate hike, while signaling that it was the end of its tightening cycle.

Turning to the weekly performance of the S&P 500 (SP500) sectors, eight ended in the green, with Utilities rising nearly 3%. Technology topped the losers, with the sector declining for a second straight week. However, Arm Holdings’ (ARM) highly anticipated market debut turned out to be a bright spot, with shares of the chip designer surging nearly 25% in their first trading day and giving the firm a valuation of over $60B.

See below a breakdown of the performance of the sectors as well as their accompanying SPDR Select Sector ETFs from September 8 close to September 15 close:

#1: Utilities +2.67%, and the Utilities Select Sector SPDR ETF (XLU) +2.79%.

#2: Consumer Discretionary +1.72%, and the Consumer Discretionary Select Sector SPDR ETF (XLY) +1.80%.

#3: Financials +1.44%, and the Financial Select Sector SPDR ETF (XLF) +1.55%.

#4: Communication Services +0.55%, and the Communication Services Select Sector SPDR Fund (XLC) +0.82%.

#5: Real Estate +0.53%, and the Real Estate Select Sector SPDR ETF (XLRE) +0.46%.

#6: Consumer Staples +0.37%, and the Consumer Staples Select Sector SPDR ETF (XLP) +0.49%.

#7: Energy +0.12%, and the Energy Select Sector SPDR ETF (XLE) -0.04%.

#8: Health Care +0.05%, and the Health Care Select Sector SPDR ETF (XLV) +0.10%.

#9: Materials -0.13%, and the Materials Select Sector SPDR ETF (XLB) -0.11%.

#10: Industrials -0.60%, and the Industrial Select Sector SPDR ETF (XLI) -0.60%.

#11: Information Technology -2.24%, and the Technology Select Sector SPDR ETF (XLK) -2.25%.

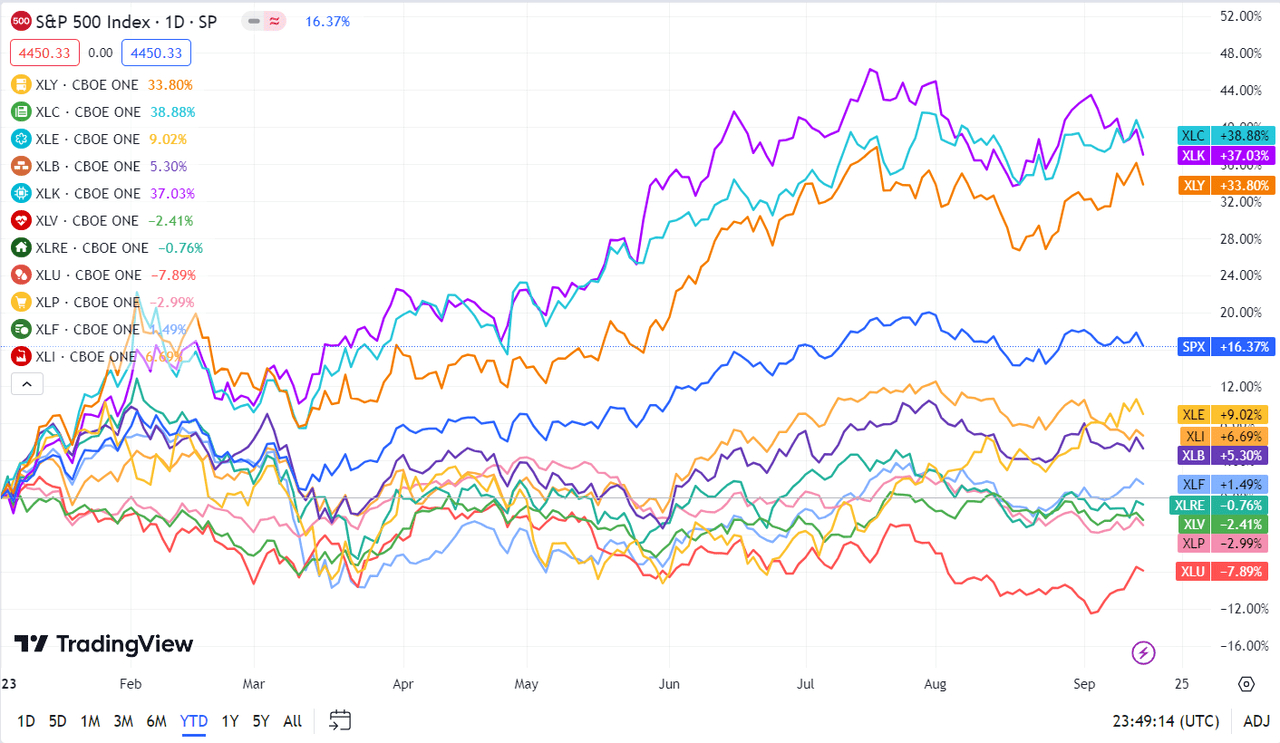

Below is a chart of the 11 sectors’ YTD performance and how they fared against the S&P 500 (SP500). For investors looking into the future of what’s happening, take a look at the Seeking Alpha Catalyst Watch to see next week’s breakdown of actionable events that stand out.