ezypix

The Industrial Select Sector (XLI) rose +0.6% for the week ending Aug. 11 and was among the 8 of the 11 S&P 500 sectors which closed the week in green. However, the SPDR S&P 500 Trust ETF (SPY) fell (-0.26%) for the second week in a row. Year-to-date, XLI has risen +10.87%, while SPY has gained +16.53%. Earnings continued to play a vital role in stock movements this week as well.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +8% each this week. YTD, all these 5 stocks are in the green.

Sterling Infrastructure (NASDAQ:STRL) +32.44%. The construction services provider saw its stock soar +22.28% on Tuesday following its Q2 results (post market a day ago) wherein the company raised its FY23 revenue outlook. YTD, the stock has surged +146.31%, the most among this week’s top five gainers for this period.

STRL has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Strong Buy. The stock has a factor grade of B+ for both Profitability and Growth. The average Wall Street Analysts’ Rating is Buy rating, wherein 1 analyst tags the stock as Strong Buy while the only other sees the stock as Hold.

Veritiv (VRTV) +18.96%. The stock soared +19.68% on Monday after Veritiv — a distributor of packaging, facility solutions and print products — said it was being acquired by an afiliate of private-equity firm Clayton Dubilier & Rice in a a $2.3B deal. YTD, the stock has risen +38.02%.

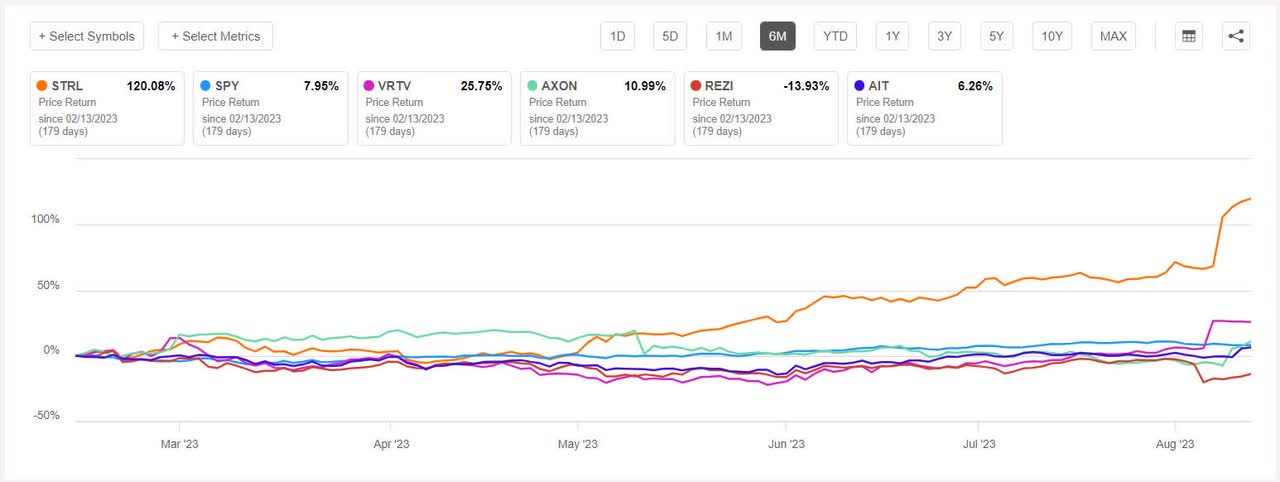

The chart below shows 6-months price-return performance of the top five gainers and SPY:

Axon Enterprise (AXON) +16.79%. The Taser energy weapon maker stock surged +14.06% on Wednesday following its Q2 results (post market a day ago), which beat estimates.

The SA Quant Rating on AXON is Hold with score of B+ for Momentum and F for Valuation. The rating is in contrast to the average Wall Street Analysts’ Rating of Strong Buy, wherein 6 out of 12 analysts see the stock as such.

Resideo Technologies (REZI) +8.06%. The Scottsdale, Ariz.-based company leapfrogged from the decliners’ list it found itself inlast week to be among the gainers this week. YTD, +0.30%. The SA Quant Rating on REZI is Hold, with factor grade of C+ for Profitability and A for Valuation. The average Wall Street Analysts’ rating is Buy, wherein 4 out of the 6 analysts view the stock as Hold.

Applied Industrial Technologies (AIT) +8%. Shares of the industrial parts distributor rose +6.73% on Thursday after Q4 GAAP EPS and revenue surpassed estimates. The SA Quant Rating on AIT is Buy, while the average Wall Street Analysts’ Rating is Strong Buy. YTD, the stock has gained +21.08%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -11% each. YTD, 2 out of these 5 stocks are in the red.

Forward Air (NASDAQ:FWRD) -29.63%. The freight and logistics company’s stock fell -25.35% on Friday after at least three firms downgraded the stock on concerns that its $3.2B cash-and-stock acquisition of Omni Logistics will add risks to the company’s business.

The SA Quant Rating on FWRD is Hold with a factor grade of B+ for Profitability and D+ for Valuation. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 4 out of 7 analysts see the stock as such. YTD, the stock has declined -25.97%.

Plug Power (PLUG) -21.19%. The shares fell -15.81% on Thursday after pushing out hydrogen production targets. The SA Quant Rating on PLUG is Sell with score of D+ for Growth and D- for Momentum. The rating is in contrast to the average Wall Street Analysts’ Rating of Buy, wherein 16 out of 30 analysts tag the stock as Strong Buy. YTD, the stock has fallen -26.35%, the most among this week’s worst five decliners.

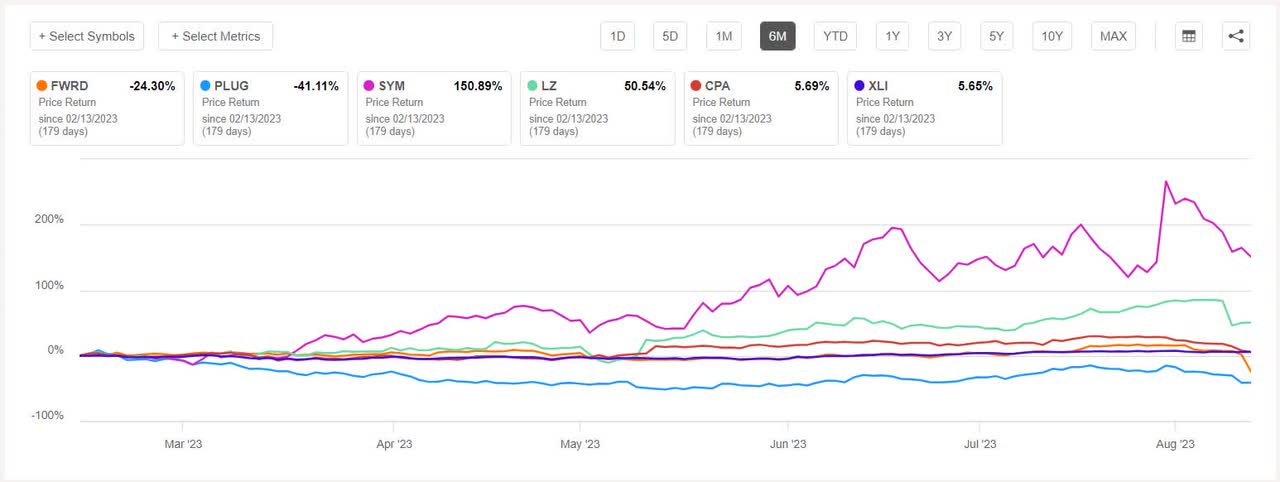

The chart below shows 6-months price-return performance of the worst five decliners and XLI:

Symbotic (SYM) -18.80%. The stock came down from last week’s rally and landed among the decliners this week. However, YTD, the stock has gained tremendously, +264.57%. The SA Quant Rating on SYM is Hold with score of D- for both Profitability and Growth. The average Wall Street Analysts’ Rating has a more positive view with a Buy rating, wherein 7 out of 13 analysts tag the stock as Strong Buy.

LegalZoom.com (LZ) -18.60%. Shares of the online legal and compliance solutions provider fell -20.46% on Wednesday after its Q2 results (post market a day ago). The SA Quant Rating on LZ is Hold, while the average Wall Street Analysts’ Rating is Buy. YTD, the stock has jumped +62.79%.

Copa Holdings (CPA) -11.13%. The Panama-based airline company’s stock declined thoughout the week, with the most on Thursday -5.44% after Q2 revenue ( reported a day ago post market) missed estimates. The SA Quant Rating and the average Wall Street Analysts’ rating, both, on CPA is Strong Buy. YTD, the stock has gained +17.46%.