I know it’s crazy, but I’m bullish again this week. But that’s just what happens in volatile markets.

I had two big alerts go out today, based on that bullishness.

The first was my new “Bright Idea” ? I sent you before the market opened today.

WARNING: Ignore my “Bright Ideas” if you hate making money LOL.

I say that because once again, my new idea today was up over 20% – in just a few hours.

I’ll share more on that tomorrow, but c’mon. This is almost “too easy!”

When the market tees up trades that I think are going up, that’s where I really like to take my swing.

That’s exactly what I told you was happening on Friday last week… and then we walked into a killer trading market today. Nearly everything is up!

I’ll only buy puts (bet against stocks) when necessary (like last week’s GDX trade I’ll discuss later), but as you know I’d rather bet on stocks going up.

Why bet on things going up, you ask?

Because, more often than not, that’s what they do.

There are so many bullish plays I can hardly count them. But I don’t want 50 trades on my book – it’s just too much to manage.

The mark of a professional trader is sifting through the GOOD and finding only the BEST ideas.

That’s exactly what I did over the weekend, and my absolute TOP IDEA went out to Bullseye Trades subscribers this morning (are you on this list yet?).

Obviously, I can’t tell you this week’s trade, but I’m going back into tech.

The QQQs are trading back above the Keltner midpoint (don’t worry if you don’t know what this means, just make sure you attend one of my upcoming LIVE training sessions!) on the daily and that’s extremely bullish for me.

In fact, I almost decided to send this as the Bullseye Trades weekly idea. But I decided to select an individual stock in the sector instead.

At the time of writing, this morning’s trade idea is VERY green – it already made a 50% move just today!

Hopefully, another major ?banger like our recent winning ideas (over 500% on LLY, 260% on QQQ the week before that… but whoh’s counting?!)

By the way, training is hard. I always hope to have gains like this, but it doesn’t always happen! ?

I am still holding my trade, and I’ll keep you posted on how it turns out later in the week.

?Numbers I Need:

I sent out my complete gameplan on this trade this morning before the bell to all my Bullseye Trade subscribers.

While I’m bullish on the market, I do expect some major volatility.

September is historically a poor month for stocks. But that doesn’t mean they’re going to drop. And even if the S&P 500 does post a net negative return for the month, it will have rallies.

And history isn’t destiny. This year has been weird all around, so we may very well have a September that’s supercharged.?

So I’m keeping a close eye on the charts.

Next, we have inflation data coming out on Wednesday. This is as news-sensitive a market as I’ve seen in years, so keep that in mind.

I may consider taking any profits I have before the announcement.

Who knows what’s going to happen?

Finally, Friday is quad witching. With trillions of dollars of options expiring market makers love to play games. Expect a wild ride going into the weekend.

?Most Exciting Action:

I’ve gotten so many comments on win rates and trading in the past few weeks that I thought I’d address it here.

I don’t know anyone who’d argue that high win rates are bad. That just doesn’t make any sense.

When I place trades, I’m not trying to lose. Winning is awesome!

However, the more important part of trading is whether or not my profits can overcome my losses. When anyone trades (including me), they’re going to lose sometimes.

That’s just how it goes.

The way I keep my P/L (profit/loss statement) ticking up ?rather than down ? is to make sure that I win more money, on average, than I lose.

It’s possible to win most of your trades and still go broke. Taking tiny wins and massive losses will wipe you out quickly.

Always look at your results and see if need to revise your strategy.

If your account value is consistently going down, then something has to change. Bullseye Trades is not just about getting trading ideas but learning how to trade.

? Past Alert Update:

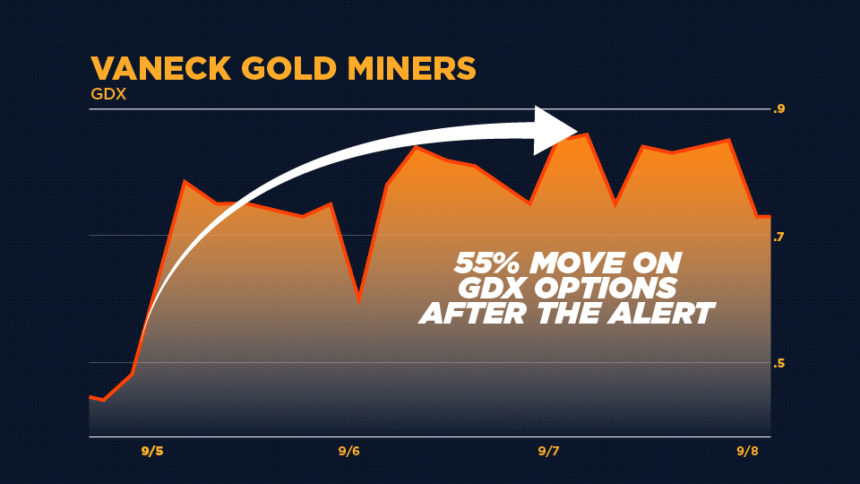

Here is my trade idea from last Tuesday.

My plan for GDX this week is to get started on a partial position sometime today, hopefully on a slight bounce higher (this would make the puts go lower.)

Then I’d like to add to the trade 1-2 days later, assuming GDX is still under my stop price of $30.

If things go my way, I think we will see GDX fall to under $28, which is my first target, and then we could see $27 or lower after that.

I am only looking for a small move lower on GDX, so I am going with options that expire in less than 2 weeks in order to capitalize on that. This creates more risk for the trade, but it also could have more upside for me if it works out.

It is going to be a fun week of trading…I hope you are ready for it!

GDX Sept 22 BUY $30 put & SELL $28 put for $.90 net debit.

Well, I got the GDX pullback I was looking for. Just a quick two days of bearish action was all that was necessary.

Just look at what happened to the options I alerted.

*trading is hard, results not guaranteed.

Sure, it wasn’t the potential 260% gain on QQQ or the 320% on LLY like the past couple of Bullseye Trades ideas, but who wouldn’t want a 55% win in a couple of days?

Certainly sounds good to me.

I send my ABSOLUTE TOP IDEA each week directly to Bullseye Trades subscribers on Monday. Sign up and get my complete game plan before the market opens.

But you’ll get even more…

You’ll also have unlimited access to our training library, trading ebook “How to Become an Alpha Hunter,” and alerts on trades I make sent directly to your Raging Bull app.

Bullseye Trades provides not just top trade ideas but a comprehensive options education system.

Stay tuned for a complete update on how this week’s Bullseye Trade worked out.

And tomorrow, we’ll discuss some key concepts for troubleshooting your trading.

If you haven’t been watching VWAP Jedi Kenny Glick, remember he’s trading live every day this week from 10:00-11:00 EST – Complimentary.

Questions or concerns about our products? Email [email protected] (C) Copyright 2022, RagingBull

DISCLAIMER To more fully understand any Ragingbull.com, LLC (“RagingBull”) subscription, website, application or other service (“Services”), please review our full disclaimer located at https://ragingbull.com/disclaimer

FOR EDUCATIONAL AND INFORMATION PURPOSES ONLY; NOT INVESTMENT ADVICE. Any RagingBull Service offered is for educational and informational purposes only and should NOT be construed as a securities-related offer or solicitation, or be relied upon as personalized investment advice. RagingBull strongly recommends you consult a licensed or registered professional before making any investment decision.

RESULTS PRESENTED NOT TYPICAL OR VERIFIED. RagingBull Services may contain information regarding the historical trading performance of RagingBull owners or employees, and/or testimonials of non-employees depicting profitability that are believed to be true based on the representations of the persons voluntarily providing the testimonial. However, subscribers’ trading results have NOT been tracked or verified and past performance is not necessarily indicative of future results, and the results presented in this communication are NOT TYPICAL. Actual results will vary widely given a variety of factors such as experience, skill, risk mitigation practices, market dynamics and the amount of capital deployed. Investing in securities is speculative and carries a high degree of risk; you may lose some, all, or possibly more than your original investment.

RAGINGBULL IS NOT AN INVESTMENT ADVISOR OR REGISTERED BROKER. Neither RagingBull nor any of its owners or employees is registered as a securities broker-dealer, broker, investment advisor (IA), or IA representative with the U.S. Securities and Exchange Commission, any state securities regulatory authority, or any self-regulatory organization. Employees, owners, and other service providers of https:// ragingbull.com or RagingBull.com LLC are paid in whole or in part by commission based on their sales of Services to subscribers.

RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements. In the event that any suit or action is instituted as a result of doing business with RagingBull.com, LLC and/or its affiliates or if any suit or action is necessary to enforce or interpret these Terms of Service, RagingBull.com, LLC shall be entitled to recover attorneys’ fees, costs and disbursements in addition to any other relief to which it may be entitled.

WE MAY HOLD SECURITIES DISCUSSED. RagingBull has not been paid directly or indirectly by the issuer of any security mentioned in the Services except possibly by advertisers in this email. However, Ragingbull.com, LLC, its owners, and its employees may purchase, sell, or hold long or short positions in securities of the companies mentioned in this communication.