(Bloomberg) — Bond investors are starting to bet the worst-ever rout in US Treasuries may soon be over.

Most Read from Bloomberg

US 10-year yields slid the most since March after dovish comments from Federal Reserve officials fueled speculation interest-rate hikes are about done, while jitters over the Israel-Hamas war added haven demand. The move was more pronounced than normal as trading of cash Treasuries had been shut worldwide Monday for a US holiday.

Two Fed officials speaking Monday expressed the idea that the recent surge in US yields may have done some of the job of tightening financial conditions for them. The US 10-year real yield is around its highest in 15 years.

The Fed speakers “seemed very much on the same page in noting higher bond yields and tighter financial conditions will impact their thinking on the Fed funds rate,” said Andrew Ticehurst, a rates strategist at Nomura Holdings Inc. in Sydney. “Market pricing suggests the Fed likely won’t hike this year,” he said, adding there may still be a risk of a final “insurance” increase.

Fed Vice Chair Philip Jefferson said he’s watching the increase in Treasury yields as a potential further restraint on the economy even though the rate of inflation remains too high. Fellow policymaker Lorie Logan said the recent increase in long-term yields may indicate less need for the central bank to raise rates again.

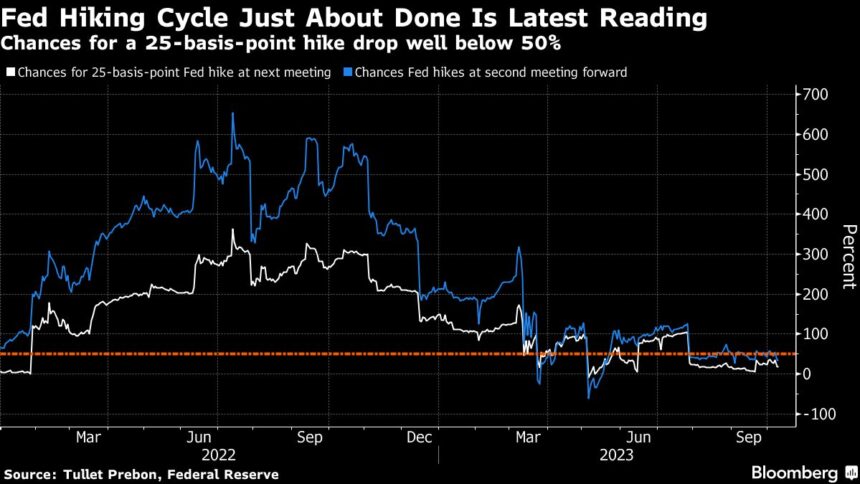

Meeting-dated swaps now show about a 65% chance the Fed will stay on hold in December, compared with 60% odds on another hike by then, just a week ago.

US 10-year yields fell as much as 18 basis points to 4.62% on Tuesday, the biggest one-day decline since March. Two-year yields slipped as much as 16 basis points to 4.92%.

German bonds, in the meantime, fell as traders pared bets on interest-rate cuts from the European Central Bank next year. The two-year rate climbed as much as four basis points to 3.08% after dropping nine basis points yesterday. Yields on short-dated gilts also rose.

ECB Governing Council member Francois Villeroy de Galhau said on Tuesday there’s no justification at present to resume monetary tightening amid a clear downtrend in inflation.

What Bloomberg Strategists Say…

“The Federal Reserve is likely to damp the mood at the November meeting, which will be an opportunity to remind investors that interest-rate cuts are not even on the agenda for now”

Mark Cranfield, MLIV strategist

Still, bond investors have had their hopes for an end to rate hikes dashed before. A rally after the banking crisis that sent 10-year yields as low as 3.25% in April was followed by waves of selling as the Fed kept on tightening policy. ECB’s Villeroy also stressed the need for vigilance on oil prices amid the Israel-Hamas conflict, which could stoke inflation expectations.

With the ECB “recently stressing that not being forceful enough with rate hikes is more costly to the economy than being overly aggressive, it may decide an additional rate increase is needed and keep interest rates at that new level for longer,” said Frederique Carrier, head of investment strategy in the British Isles at RBC Wealth Management.

Treasury yields have surged in recent months amid concern stubborn inflation will convince the Fed to keep borrowing costs higher for longer. An index of US government debt has dropped 2.6% this year, heading for a third year of losses.

The Fed’s rate increases have so far failed to bring inflation back down to its 2% target, and the US economy still appears to be resilient. Yields have also risen this year on concern about increased Treasury issuance, which is needed to fund widening government deficits.

The recent run up in yields “might give the Fed extra reason for pause in the short run, but it’s too early to call this justification for the end of the cycle,” said Robert Thompson, macro rates strategist at Royal Bank of Canada in Sydney.

–With assistance from Alice Gledhill.

(Adds additional context, comments and updates prices throughout.)

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.