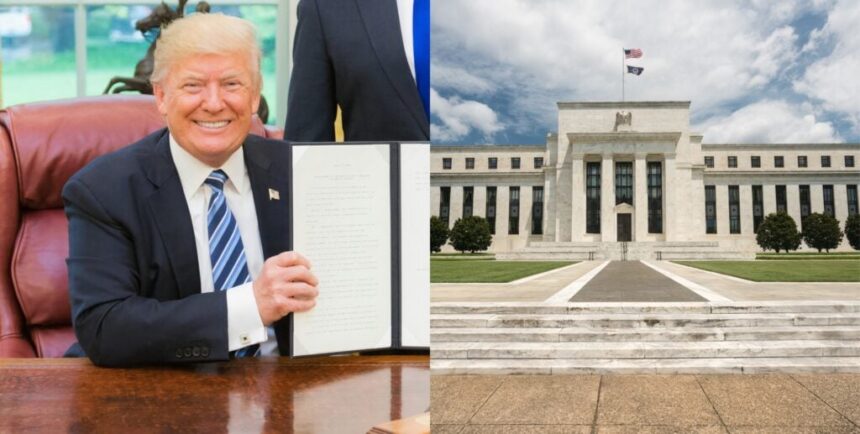

A group of former officials and other allies of Former President Donald Trump has drafted a document outlining suggested policy changes that would impact the authority and independence of the Federal Reserve. While it’s not clear whether Trump was involved, some say he approved of the effort. Trump has expressed to his advisors that he prefers a low interest rate environment and has publicly blamed economic issues on the central bank’s monetary policy decisions, denouncing chairman Jerome Powell as “political.”

Ironically, the document proposes changes that could make the Federal Reserve more vulnerable to political influence. For example, it suggests the president should oversee federal funds rate decisions, as well as have the authority to demote Powell before the end of his term.

Politicians on both sides of the political spectrum who value the Fed’s independence, including former Trump administration officials, have expressed alarm at the idea of allowing the White House to intervene in the Fed’s decision-making processes and warned of dire consequences for the global economy if this comes to fruition. On the other hand, some Trump advisors believe it’s unconstitutional for the Fed to operate without interference and that the Fed’s independence leads to policy errors that hurt the U.S. economy.

It’s not clear whether stripping the Fed of its autonomy would be legally feasible since such a policy would face numerous institutional obstacles. And Trump’s senior advisors say the policy recommendations shouldn’t be considered official at this time. Nevertheless, as the debate over the optimal role of the central bank picks up, it’s worthwhile to understand the potential implications of restricting the Fed’s independence.

Why the Fed Maintains Its Independence

The Fed’s dual goal is to maintain maximum employment, a flexible measure based on factors in the labor market, while also keeping inflation stable at a target rate of 2% per year. It achieves both through monetary policy, primarily by adjusting the target for the federal funds rate, in an effort to either encourage or restrict economic growth and consumer demand.

Congress decided that the Fed is most effective when it makes monetary policy decisions solely based on economic conditions and structured the central bank as an independent agency to ensure it isn’t subject to political pressures. The reasoning goes that the federal government may have political motivations for keeping interest rates low in an election year, even if loose monetary policy wouldn’t benefit the economy in the long term.

The Fed is still accountable to Congress and subject to independent audits, but its independence allows for policy decisions based on objective economic data. Additionally, while the president appoints members of the Fed’s board of governors and the Senate approves the appointments, the president doesn’t have the authority to remove a governor over a policy disagreement. Fed governors also have staggered 14-year terms, making it difficult for a president to completely reshape the board according to their political preferences.

Historical evidence indicates that independent central banks are more successful at keeping prices stable. Studies from the International Monetary Fund show that countries with independent central banks experienced lower inflation rates and better long-term economic outcomes.

However, credibility and accountability are essential to achieving these benefits. Some argue that too much operational independence in a federal agency is contrary to democracy and that freedom from political influence requires a balance between independence and accountability. For example, the Manhattan Institute advocates for an overhaul of the Fed’s governing structure—one that increases White House oversight while also allowing for the democratic participation of more Reserve Bank leaders in monetary policy decisions.

How Trump Allies Want to Limit the Fed’s Authority

While the details of the plan are not available to the public, some Trump advisors have discussed requiring Fed governors to consult with the president on the agency’s rate-setting agenda. Others have suggested that Trump should serve on the board in an official capacity, though several Trump allies have called that idea far-fetched.

The document also suggests requiring the Fed to undergo a formal review process when issuing new policies, similar to other government agencies within the Office of Management and Budget, and giving the Treasury Department more authority over emergency lending programs offered jointly with the Fed.

The group of Trump allies is also working out how to give Trump the authority to remove Jerome Powell from his position as chairman should the former president be reelected. This would likely require demoting Powell and replacing him with another sitting board member since the law is clear that a governor’s term can’t be cut short due to policy disagreements.

The Potential Impact on Mortgage Rates and the Global Economy

While political influence on monetary policy might lead to artificially low mortgage rates initially, some Trump advisors think the plan could have negative consequences.

For example, lenders may respond directly to the prospect of uncontrolled inflation by setting higher risk premiums on mortgages, reasoning that future interest payments over the term would have reduced purchasing power. And if investors caught wind of the fact that the president supported cutting rates amid high inflation, they might lose confidence in the Fed’s ability to respond to economic conditions. Their inflation expectations could lead to weaker demand for U.S. debt securities. The market would respond with higher Treasury yields, which would push mortgage rates higher.

If economic uncertainty triggered a long-term bond selloff, the stock market would also decline. Investors might lose confidence in the nation’s financial stability and become more aversive to long-term investment commitments. REITs, which are particularly sensitive to changes in Treasury yields, would drop in value dramatically.

And since the U.S. economy is the world’s largest and the U.S. stock market serves as a global benchmark, a loss of confidence in U.S. financial stability could lead to global market volatility. International investors might withdraw from the U.S. market, which would further reduce stock prices.

That doesn’t mean that reforming the Fed is impossible without global financial chaos. But any changes to the Fed’s governance need to ensure confidence in the agency’s separation from political interference. Congress has reshaped the Fed many times throughout history, but typically, it’s taken legislative action to provide the agency with more autonomy.

However, when former president Richard Nixon appointed Arthur Burns to lead the Fed from 1970 to 1978, a more cooperative relationship ensued. Burns was accused of orienting the Fed’s policy decisions toward the president’s preferences, and most economists believe more White House influence led to a painful period of high inflation that negatively impacted the economy for many years. So, with history as a guide, the markets are likely to respond to any Fed reform that threatens a recurrence of the Burns situation.

It may be possible for Congress to make changes that increase the Fed’s accountability without leaving the agency vulnerable to political influence and triggering economic strife. For example, some advocates for reform within the Fed have recommended requiring actual experience in financial markets for Fed governors and allowing all Reserve Bank presidents to be involved in every budgetary and monetary policy decision. Other suggestions include eliminating the maximum employment mandate and removing conflicts of interest—for example, limiting the Fed’s portfolio to Treasury securities and prohibiting the central bank from issuing and enforcing regulations.

The intent of these proposed changes is to increase accountability for the Fed and reduce political interference. But, allowing the president to influence the Fed’s decisions directly would invite significant political pressure. So, the draft document raises concerns, even among Trump administration officials.

Ian Katz, director of research consultancy firm Capital Alpha Partners, explained to The Hill that Trump allies’ recommendations would impact the markets dramatically, saying: “There are plenty of people in the markets who would like to see Trump be president again. I don’t think there are plenty of people in the markets who would like to see Trump be de facto Fed chair.”

The Bottom Line

Trump was not the first president to blame the Fed for the nation’s economic troubles—the independence of the central bank makes it a convenient scapegoat. The Fed has made policy errors throughout history that many believe hurt the economy, so it’s reasonable for an administration to question the rules governing the agency.

Ultimately, this is just one extra issue voters will have to weigh when going to the ballot box this November.

Ready to succeed in real estate investing? Create a free BiggerPockets account to learn about investment strategies; ask questions and get answers from our community of +2 million members; connect with investor-friendly agents; and so much more.

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.