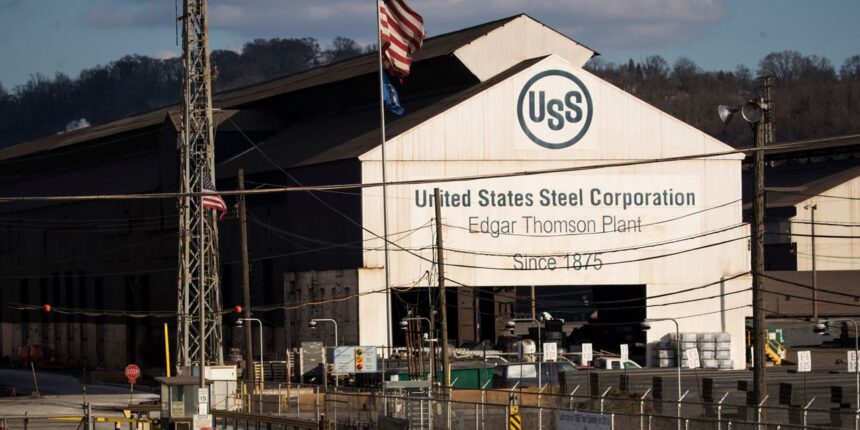

U.S. Steel has rejected an unsolicited, $7.3 billion takeover bid from Cleveland-Cliffs Inc. that would have reshaped America’s steel industry.

In a statement Sunday, Ohio-based steel producer Cleveland-Cliffs

CLF,

made public a previously private offer to buy U.S. Steel

X,

for a per-share value of $17.50 in cash and 1.023 shares of Cliffs stock, for an implied valuation of $35 a share — a 43% premium based on Friday’s closing stock price and valuing the company at about $7.25 billion.

Cliffs said the offer was rejected Sunday by U.S. Steel’s board, which it said called it “unreasonable.”

“As such, I believe it necessary to now make our proposal public to help expedite substantive engagement between our two companies,” Cliffs Chief Executive Lourenco Goncalves said in a statement, adding that the proposal “has the full support of the United Steelworkers union.”

Earlier Sunday, U.S. Steel announced its board was evaluating “strategic alternatives” for the company following a number of acquisition offers.

“U.S. Steel’s board and management team are committed to maximizing value for our stockholders,” CEO David B. Burritt said in a statement. “This decision follows the company receiving multiple unsolicited proposals that ranged from the acquisition of certain production assets to consideration for the whole company. The board is taking a measured approach to considering these proposals.”

Burritt continued: “Our balance sheet is stronger than ever, and we are delivering resilient cash flow while prioritizing direct returns to stockholders. The interest demonstrated by the unsolicited proposals received to date is a validation of U. S. Steel’s strategy and successful track record of execution.”

Burritt said there was no deadline or timetable for the strategic-review process.

U.S. Steel did not immediately reply to a request for comment on Cliffs’ offer.

U.S. Steel had a market cap of $5.07 billion as of Friday, according to MarketWatch data. Its shares are down 9.3% year to date.

Cleveland-Cliffs shares are down 8.8% this year, and the company’s market cap was $7.47 billion as of Friday.