There were very few industries that weren’t affected by the COVID-19 pandemic, and the UK finance industry was no exception. Driven by restrictions on physical locations, the industry as a whole forged a greater reliance on digital channels. The move to a predominantly digital model was a long-time coming, innovations in financial technology have created a more seamless digital banking experience for consumers, and contactless technology has streamlined and improved consumers’ payment experience. As a result of these advances in technology, the use of cash has been consistently falling in the UK for years now. The future of spending is undoubtedly digital.

For almost two years now, Brits have been living through a cost of living crisis. Naturally, this has had a negative impact on the finances of many households. The economic crisis has eroded consumer financial wellbeing and confidence. Mintel’s consumer research has found that just one in four Brits describe their personal finances as healthy. It is no surprise then that this decline financial wellbeing has had an impact on consumers’ spending habits, particularly in relation to payment preferences. We have outlined how the ongoing economic difficulties have affected consumer behaviour, and examined whether cash is ready to stage a comeback in an increasingly digital world.

Payment Preferences in a Cost of Living Crisis

A quarter of UK credit card owners have been using their card more frequently in the last 12 months, highlighting the role of cards in everyday spending as a result of increased economic pressures. Overall, debit cards continue to be the favoured payment method, but the use of cash is on the rise again across all age groups. Half of Britons aged 16-34 years-old use cash on a weekly basis. There is a desire for choice when it comes to payment methods, and businesses need to be mindful of this in the future.

During the COVID-19 pandemic, hygiene was suddenly a priority focus for most people. The idea of a pound coin or a ten pound note covered in the bacteria from all those who’ve handled it before put many people off using cash. Use fell dramatically as people opted for the more hygienic option of contactless payments. But as the pandemic fades into memory, the cost of living crisis has replaced it at the forefront of consumers’ minds. Mintel has found that the decline in cash use has slowed as consumers navigate the ongoing economic crisis, with many finding it easier to budget and keep track of spending when using cash. This is reflected in two-thirds of people saying cash importance has increased during the cost of living crisis, while almost nine in ten say it is important to keep cash as a precautionary measure. While cash may no longer be king, it is not ready to renounce its claim to the throne just yet.

Budgeting – The Only Way is App

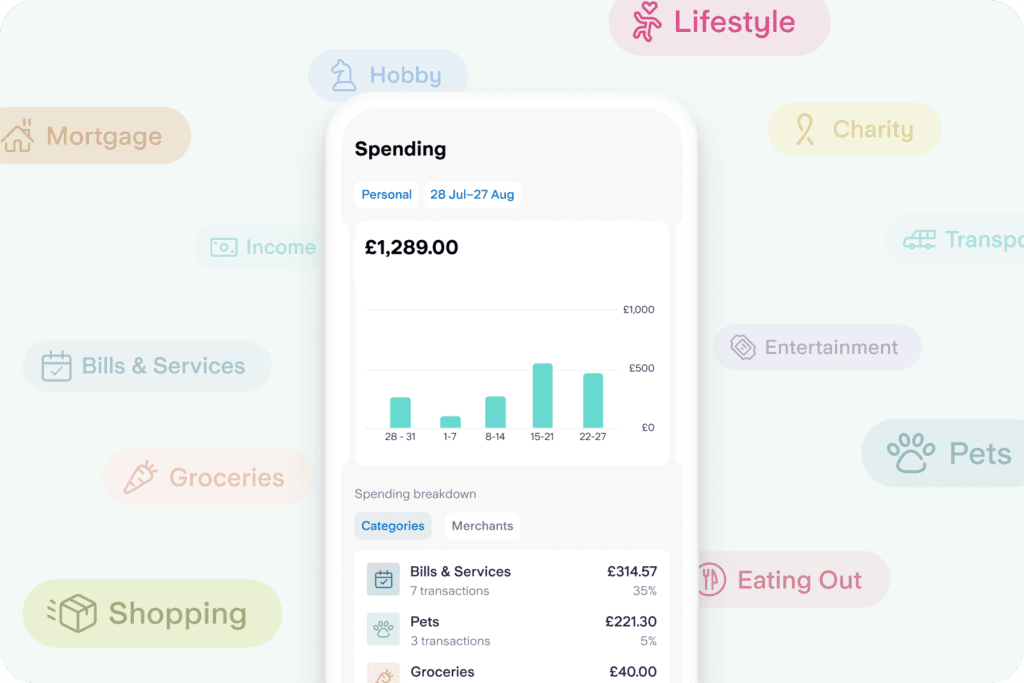

An increasing number of consumers are feeling the need to track their spending more closely, and one popular way to do this is through the use of money management apps. The rise in popularity of digital-only banks, such as Starling Bank and Revolut, has driven innovation in the FinTech industry. The evolution of smartphone technology and a continuing shift away from branch banking is driving growth in the use of financial apps. Technology has become an instrumental part of financial management, and the use of financial apps is now the norm, with two-thirds of Brits accessing them at least once a day.

Visit Mintel Store for more Finance Industry Market Research

However, while payments and transfers dominate this use, and only a small percentage of financial app users use them to budget,this is likely to rise as the cost of living crisis progresses. There will be a more pressing need to budget, and there will be an opportunity for financial service providers to expand the use of budgeting tools within their apps. Starling bank launched a free budget planner in September 2022 to help customers cut costs. Budgeting tools is an area within digital banking that currently scores relatively low in terms of satisfaction, so there is a clear need to improve. Banks and financial services providers should follow Starling’s lead and look to enhance their budgeting tools.

Open Banking: An Open Goal for the Banking Industry?

The year 2023 marks the fifth anniversary of open banking in the UK. This innovative technology offers a simple, secure way for consumers and businesses to move and manage their money. The use of open banking will continue to expand, Mintel’s research uncovered that almost a quarter of UK consumers who have not yet used open banking before are likely to use it in the future. The technology greatly helps those looking to improve their budgeting and financial planning capabilities. It relies on consumers being willing to share their data, which more consumers are willing to do as a result of the cost of living crisis. It is important that brands continue to innovate around the budgeting and planning tools that can improve consumers’ financial confidence and wellbeing. A growing number of consumers are comfortable sharing their financial data, but there must be a clear incentive and benefit.

Is the Future Cashless, or Just Less Cash?

There is a clear generational divide in willingness to use technology. Less than a tenth of consumers aged 55+ use a mobile wallet, such as Apple Pay, compared to over half of 16-24 year olds. The same applies to most financial apps; usage is much higher across younger age groups. As a result, the financial services industry is at a crossroads. Does it push innovation and move towards a cashless society, at the risk of alienating older consumers? Immediately post-pandemic (and pre-cost of living crisis), the answer may have been more straightforward. But now that economic difficulties have driven consumers back to cash, the answer, for now at least, is for financial service providers to find a balance between the two.

There is a strong opportunity for finance brands to engage with younger consumers through the use of apps and innovative technology, but older consumers, who prefer a more traditional way of banking must also be catered for. If the UK is to move closer towards a cashless society, it is vital that there is strong communication between the government, banks and consumers to ensure that no one is left behind.

What We Think

The use of digital banking in financial services is going to grow, with or without a cost of living crisis. However, it is clear that many consumers, particularly older, are not willing, or do not have the means, to go completely digital, so financial brands must continue to cater for them.

Consumer sentiment about a cashless society remains more negative than positive and considerable effort from the government, banks and businesses will be required before people are ready to give up on cash. Ultimately, consumers want flexibility around their payment options; as previously mentioned, it is not just older consumers who still want the option of cash payments.

Explore our Financial Services Market Research, or fill out the form below to sign up to Spotlight, Mintel’s free newsletter for exclusive insights.

Sign up to Spotlight