Shrinkflation isn’t a new phenomenon. As a term, it gained significant traction in the late 2010s and early 2020s, particularly during periods of economic uncertainty and rising inflation. However, what’s different today is the attention shrinkflation as a tactic continues to gain.

As of August 2024, the hashtag #shrinkflation has garnered 86 million views on TikTok, as users take to their screens to expose the brands that use the tactic and share tips on getting the best value when shopping. This heightened consumer awareness is driving a shift towards more thoughtful and savvier shopping habits.

Join Mintel as we explore how brands can navigate the complexities of shrinkflation. We’ll deep dive into innovative strategies in the Food and Beauty industries across the globe to help you refine your messaging to align with consumers’ evolving needs and preferences. Learn how to strengthen your brand’s resilience in the face of rising costs and stay ahead in a challenging market landscape.

What is Shrinkflation?

Shrinkflation, a clever portmanteau of “shrink” and “inflation”, is a subtle yet significant strategy where companies reduce the size or quantity of a product while keeping the price the same, or even make price points slightly higher. This form of price inflation often goes unnoticed by consumers if the changes happen gradually over time. It’s a tactic increasingly common in the Food and Beauty industries, enabling brands to effectively raise prices without making it too obvious to the average consumer.

Is Shrinkflation Legal?

Shrinkflation may not break any specific laws, but it does tread a fine line when it comes to ethics. While there are no legal requirements to disclose subtle size reductions, failing to clearly inform consumers can easily be viewed as misleading and a deceptive form of marketing.

However, in industries like Food and Beauty, where inflationary pressures are squeezing margins, shrinkflation is increasingly seen as a necessary strategy. The key to maintaining consumer trust lies in transparency – if brands are honest about these changes, they can navigate the challenges of rising costs, while maintaining consumer trust.

Consumer Attitudes Towards Shrinkflation and Inflation in the Food Industry

In the UK, surging inflation is driving consumers to change their shopping habits and adopt more value-seeking behaviours, such as switching to budget brands. Over three in ten UK consumers expect to shop more at discount retailers, with many also expecting to buy more own-label packaged goods. While some food brands are passing on costs to consumers, others are turning to shrinkflation, resizing their products to maintain price points despite ongoing inflationary pressures.

As highlighted in our UK Food Packaging Report, the rise in packaging material costs is further prompting manufacturers to explore lighter weights and reduced packaging, which will reshape the demands in the packaging industry. Packaging companies will now need to be more agile and collaborative to help brands sustainably mitigate costs.

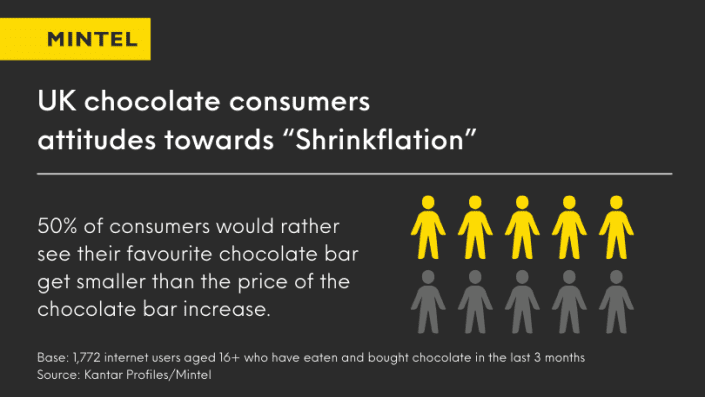

Mintel has observed that several chocolate brands have employed shrinkflation to offset declining volume sales. For instance, in the everyday chocolate category—which includes single-serve and multi-serve formats like bars, blocks, and bags—the average volume per unit sold decreased from 101.5g to 98g between 2021 and 2024, reflecting a 3.5% reduction in size. However, some products have been downsized even more significantly to absorb cost increases without raising prices.

Notable examples of shrinkflation have made headlines, such as Galaxy bars shrinking by 10%, Cadbury Dairy Milk reducing the size of sharing bags and Quality Street tubs becoming smaller. Many consumers display positive reactions to the shrinking of their chocolate; half of UK consumers say they would rather see their favourite chocolate bars get smaller than have the price go up.

In Canada, a similar story emerges. Over four in ten food and drink consumers are open to smaller portions if it helps keep prices under control. This suggests that brands can use shrinkflation as a viable alternative to raising prices. To engage consumers in the face of shrinkflation, brands can focus on transparent communication and value-driven strategies. By communicating openly, such as through social media challenges, or packaging labels, brands can build trust and maintain customer loyalty.

To further mitigate the negative impact of shrinkflation, some food brands are emphasising the quality of their ingredients. This approach resonates with more than half of UK consumers, who would rather have a small amount of premium chocolate rather than a larger amount of regular chocolate. Strategies like this not only justify the reduced size but also enhance the value of the product.

Meanwhile, as of July 2024, the French government has introduced a decree requiring retailers to inform consumers of shrinkflation. This change speaks to the growing distrust between brands and consumers when it comes to product prices. Although inflation in France has eased over 2024, the cumulative effect of price increases over the past two years means that many consumers are still feeling the pinch, with 71% reporting they have been affected by increases in food and drink prices (client access only). While consumers may accept smaller pack sizes as a cost-cutting measure, they expect brands to be clear and transparent about these changes. To maintain trust, it is crucial that brands communicate openly about adjustments in product sizes.

Explore our Food Market Research

Consumer Attitudes Towards Shrinkflation and Inflation in the Beauty Industry

Shrinkflation as a tactic has been a long-standing strategy in the beauty industry. However, the increased use of social media platforms like TikTok and Instagram are placing this practice under scrutiny as consumers are empowered with knowledge and are exposing the subtle reductions in product size or price increases that might have otherwise gone unnoticed. This heightened awareness means that brands risk being seen as opportunistic, undermining trust and supporting a narrative that businesses are prioritising profit over consumer welfare.

To help moderate the negative impact of shrinkflation, brands in the beauty industry are innovating with strategies that maintain consumer confidence and engagement. One effective approach is offering sampling options alongside unaltered full-sized products. This strategy not only reassures consumers that they aren’t being tricked into paying more for less but also aligns with their desire for value. Minis, samples, and testers are particularly appealing to beauty shoppers, especially Generation Z, who appreciate the opportunity to explore products without generating waste. By providing these trial options, brands can foster loyalty while minimising the perception of shrinkflation as a purely profit-driven move.

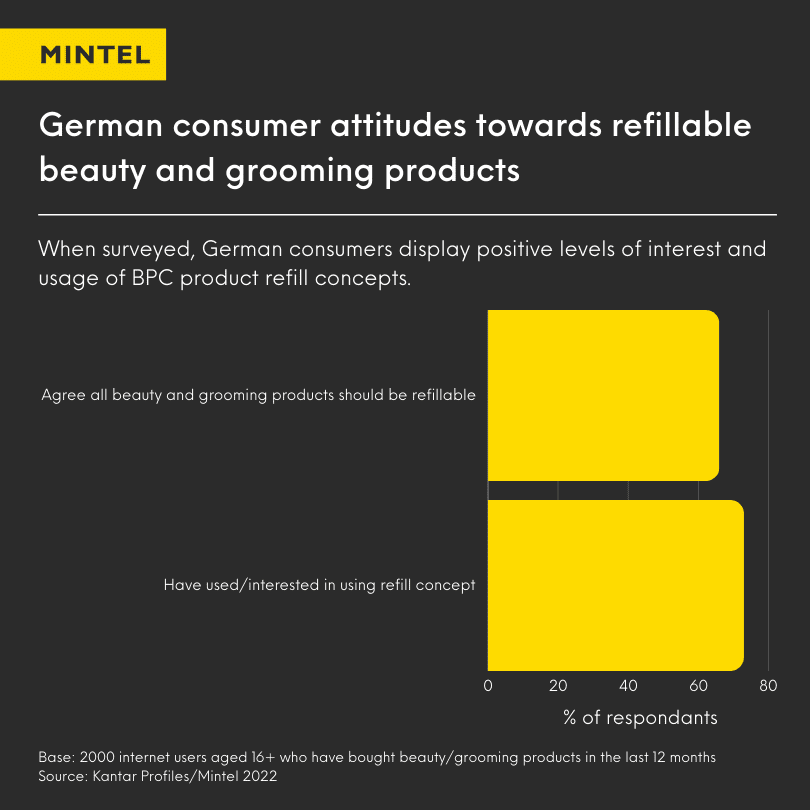

Another powerful strategy is the introduction of refillable packaging in the beauty industry, which resonates with budget-conscious consumers and those committed to sustainability. Over three in five US makeup users show interest in cosmetics in refillable packaging. Similarly, 66% of German cosmetic consumers believe all grooming products should be refillable, with almost three-quarters having used or wanting to try refillable options. This approach not only appeals to clean and eco-conscious beauty shoppers but also offers a cost-effective solution that enhances brand loyalty. By emphasising the dual benefits of reducing packaging waste and saving money, brands can position themselves as both socially responsible and consumer-friendly, effectively countering any negative perceptions associated with shrinkflation.

As consumers are forced to reevaluate their purchasing priorities during times of financial uncertainty, the pressure is on beauty brands to prove their worth and genuine support to their audience. One way of doing this is to build trust and maintain loyalty with transparent price strategies. A standout example of this initiative is the US skincare brand Cocokind. In a bold move, Cocokind took to Instagram to share a visual breakdown of its product costs, detailing salaries, corporate costs, shopping, marketing, and reinvestments. Cocokind’s initiative includes consumers in the brand’s journey, making them feel valued and informed about the reasons behind pricing decisions, therefore, making them more likely to accept increases.

Explore our Beauty Market Research

Challenges Brands Face When Implementing Shrinkflation

While it can be a viable strategy, shrinkflation presents several challenges that brands need to consider:

- Consumer backlash

In the age of social media, consumer vigilance of shrinkflation has reached new heights. TikTok has become one of the go-to platforms to voice their concerns, with #shrinkflation garnering 86 million views as of August 2024. When consumers notice shrinkflation, they are quick to share their findings online. Users are known to add photos of the product and brand logo to prove the changes, often tagging the brand directly on platforms like X (formerly known as Twitter) where customer service teams have to respond publicly to the allegations. This public display can impact consumer perceptions of the brand’s value by fostering distrust and can be viewed as a form of deceitful packaging, leading to a more educated and sceptical consumer base. - Regulatory scruity

The potential pitfalls of shrinkflation can extend beyond consumer perception to include regulatory challenges. As we observed with the French government recently introducing a decree requiring retailers to inform consumers of shrinkflation, this practice can attract scrutiny from consumer protection agencies and governmental bodies. Brands must be aware of the regulatory environment and ensure that any adjustments to size or pricing are communicated clearly to not only maintain compliance but also their reputation. - Long-term imapct on brand value

While shrinkflation may provide short-term relief from rising costs, its repeated use can have lasting negative effects on the brand’s value and reputation. As consumers become more aware and sensitive to these tactics, it can erode their trust, leading to a decline in loyalty, thus, making it difficult for the brand to maintain its competitive market position.

Innovation Opportunities for Brands Navigating Shrinkflation

Below, we summarise the top four strategies brands can implement to help maintain consumers’ trust when using shrinkflation.

- Communication and trust

Clear and effective communication about shrinkflation is crucial for maintaining trust. Brands should be transparent about the reasons behind their decision to shrink product sizes, such as increased production costs or supply chain challenges. By using social media, press releases and other communication channels, brands can present shrinkflation as a necessary adjustment to help consumers save during difficult economic times. - Empathetic support

During economic turndowns, consumers are more likely to favour brands that show empathy and understanding of their financial struggles. Brands can create empathetic messaging campaigns and provide tangible financial assistance to appear genuine and supportive of consumer experiences during tough economic times, helping to bolster trust and loyalty among consumers. - Demonstrate additional value

To counteract the negative perception of shrinkflation, brands should focus on highlighting the additional value they provide beyond just the product size. Brands can accentuate their value proposition by offering a blend of psychological, functional, and economic benefits. This approach helps consumers perceive they are making smart choices rather than compromising on quality. - Transparency in pricing

When price increases are necessary, brands should use simple language to clearly explain the need for the increase. Linking these explanations to a customer-centric value narrative, such as improving product quality or supporting sustainable practices, can further enhance trust and maintain a positive relationship with consumers.

Looking Ahead with Mintel

While shrinkflation may be an unavoidable response to economic pressures, how brands navigate this practice can significantly impact their relationship with consumers. As consumers become more informed and sceptical, it is essential for brands to prioritise transparent communication, demonstrate empathy, and highlight the additional value they provide. By explaining the reasons behind shrinkflation and emphasising their commitment to quality and sustainability, brands can transform this challenge into an opportunity to strengthen consumer trust and loyalty, even in tough economic times.

For brands looking to get strategic insight into their global sustainability messaging, take a look at Mintel’s new Consumer Sustainability Study 2024-25.

Subscribe to Mintel’s free newsletter, Spotlight, to get exclusive content and insights delivered directly to your inbox.

Sign up to Spotlight