imaginima

The Industrial Select Sector (XLI) reversed course from being in red last week to close the week ending Aug. 25, gaining +0.28%. The SPDR S&P 500 Trust ETF (SPY) snapped out of a three-week losing streak to gain +0.79% for the week. XLI was among the 7 of the 11 S&P 500 sectors which ended the week in gains. Year-to-date, XLI has climbed +8.48%, while SPY has risen +15.05%.

The top five gainers in the industrial sector (stocks with a market cap of over $2B) all gained more than +4% each this week. YTD, all these 5 stocks are in the green.

Vertiv (NYSE:VRT) +10.39%. The Ohio-based company, which provides infrastructure and services for data centers, saw its stock surge the most on Friday +7.11%. The stock was also the top gainer three weeks ago on the back of its Q2 results. YTD, the shares have gained +174.52%, the most among this week’s top five for this period.

VRT has a SA Quant Rating — which takes into account factors such as Momentum, Profitability, and Valuation among others — of Hold. The stock has a factor grade of C+ for Profitability and A for Growth. The average Wall Street Analysts’ Rating differs with a Strong Buy rating, wherein 8 out of 11 analysts tag the stock as such.

Hubbell (HUBB) +6.57%. The electrical products maker has a SA Quant Rating of Hold with score of A for Momentum but D- for Valuation. The average Wall Street Analysts’ Rating agrees with a Hold rating of its own, wherein 7 out of 11 analysts see the stock as Hold. YTD, +37.83%.

The chart below shows 6-month price-return performance of the top five gainers and SPY:

ATS (ATS) +5.82%. The Canadian company, which builds automated manufacturing and assembly systems, has gained +38.85% YTD. ATS has a SA Quant Rating of Hold with factor grade of B for Growth and C- for Valuation. One Wall Street Analyst’s rating on the stock is Strong Buy.

Regal Rexnord (RRX) +5.11%. The industrial powertrain manufacturer has a SA Quant Rating of Hold, which is in contrast to the average Wall Street Analysts’ Rating is Strong Buy. YTD, the shares have surged +29.19%.

Dycom Industries (DY) +4.88%. Shares of the company, which offers contracting services to telecommunications providers, rose +3.94% on Wednesday after Q2 results beat estimates. The SA Quant Rating on DY is Buy, while the average Wall Street Analysts’ Rating is Strong Buy. YTD, +5.48%.

This week’s top five decliners among industrial stocks (market cap of over $2B) all lost more than -5% each. YTD, 2 out of these 5 stocks are in the red.

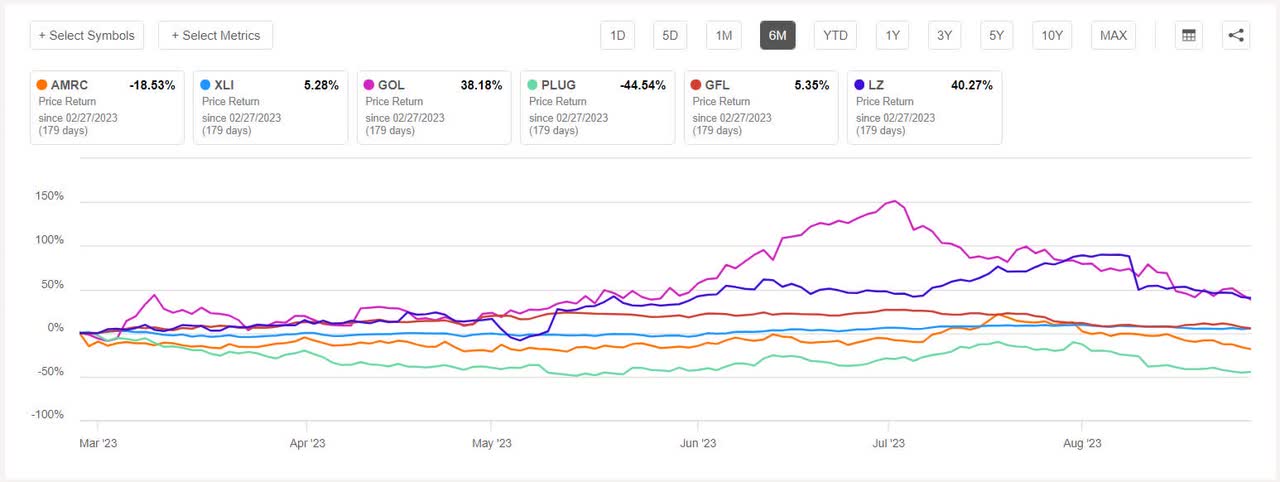

Ameresco (NYSE:AMRC) -11.01%. The Framingham, Mass.-based company saw its stock decline throughout the week. The SA Quant Rating on AMRC, which provides energy efficiency solutions, is Hold with a factor grade of A- for Growth and C- for Valuation. The average Wall Street Analysts’ Rating is more positive with a Strong Buy rating, wherein 10 out of 14 analysts view the stock as such. YTD, the shares have fallen -26.15%.

Gol Linhas Aéreas Inteligentes (GOL) -7.60%. The Brazilian airline’s stock slumped the most on Monday (-4.86%). However, YTD, the shares have risen +13.86%. The SA Quant Rating on GOL is Hold with score of A+ for Profitability and B- for Momentum. The average Wall Street Analysts’ Rating concurs with a Hold rating of its own, wherein 6 out of 8 analysts tag the stock as such.

The chart below shows 6-month price-return performance of the worst five decliners and XLI:

Plug Power (PLUG) -5.90%. Plug was also among the top five decliners two weeks ago. The SA Quant Rating on PLUG is Sell with score of F for Profitability and A+ for Growth. The rating is in stark contrast to the average Wall Street Analysts’ Rating of Buy, wherein 15 out of 29 analysts tag the stock as Strong Buy. YTD, the stock has fallen -24.28%, the most among this week’s worst five decliners.

GFL Environmental (GFL) -5.17%. The Canadian waste management services provider’s stock fell this week, however, YTD, the shares have gained +10.50%. The SA Quant Rating on GFL is Hold, while the average Wall Street Analysts’ Rating is Buy.

LegalZoom.com (LZ) -5.13%. Shares of the online legal and compliance solutions provider have surged +48.06% YTD, the most among this week’s top five decliners. The SA Quant Rating on LZ is Hold, while the average Wall Street Analysts’ Rating is Buy.