What does wellness look like to you? Maybe it’s cycling to the shops rather than driving, taking the stairs instead of an elevator, or swapping an alcoholic drink for a non-alcoholic one on a weekend.

Recent years have forced consumers to rethink their approach to health and wellness. As lifestyles have become more home-based, many consumers are taking control of their health by tracking it, becoming more conscious of their decisions when it comes to their physical and digital wellbeing.

In 2024, we’ll see how the legacy of the pandemic and the cost of living crisis have shaped consumer behavior, news that brands across multi-billion dollar industries will be keen to know more about.

1. Consumers want food, and they want it fast

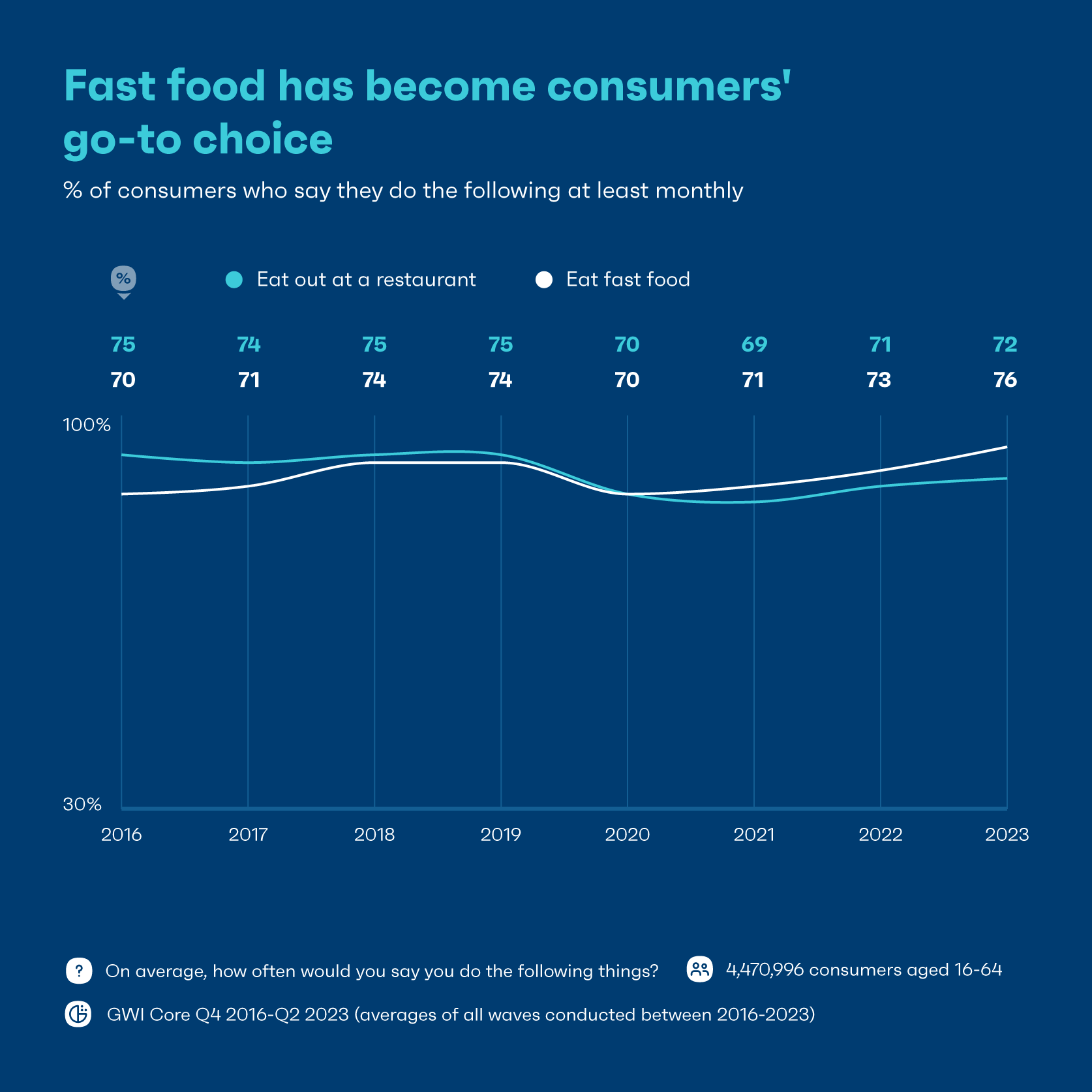

Pre-pandemic, consumers were as likely to be eating fast food as they were to go to a restaurant. But tastes have shifted – fast food is now consumers’ go-to.

The growing taste for fast food links to another trend: consumers want more convenience. From 2020-2023, there’s been a 26% rise in the number of Americans saying they often eat meals on-the-go.

For brands, this presents some interesting opportunities. They can benefit by understanding fast food eaters, and how they’re different from your average consumer.

Globally, regular fast food eaters (those that have it at least weekly) are 29% more likely to say the option to use a “buy” button on a social network would most increase their likelihood of buying a product online. They also stand out for being motivated to buy when there’s click-and-collect delivery, as well as guest check-outs, a symptom of this push for more convenience and choice.

So if you’re a food delivery brand or quick-service restaurant, how do you make the most of this? It’s about engaging your customers across multiple channels, making the in-store, online, and mobile experience seamless. When interacting with your brand, the user experience should be streamlined, like ordering online and collecting in-store, with convenience at the center.

2. Consumer health is on the decline

In 2021, Americans were dealing with the tail end of the pandemic, but consumers were fairly optimistic about their overall health. Since then, the number who say they’re in excellent health has declined by 22%, and the number who worry about their personal health frequently has risen by 17%. The US health care system has long been expensive and inefficient, health benefits and insurance are a luxury to many, and so now Americans are changing their approach to managing their health.

Since the end of 2020, we’ve seen upticks in various health conditions, with more Americans saying they’ve experienced or are currently experiencing chronic or severe pain (+38%), depression (+37%), backache (+24%), and high blood pressure (+11%).

The fact is many consumers are starting to see their health as an investment, with the catchy phrase “health is wealth” regularly used by the media, and they need tools to help them manage these issues. The self-care industry has also become a huge market, one that all kinds of brands can tap into.

3. More consumers are being proactive about their health

In 2024 we’ll see the continued growth of a specific type of consumer – the proactive health manager. That isn’t someone who works in the health care industry, but those who actively take preventative measures to better manage their health.

Since Q3 2021, the number of Americans who actively look for lifestyle changes that could improve their health has grown 13%, the number who’ve purchased vitamins/supplements in the last month is up 15%, and the number who’ve bought health foods is up 7%.

More consumers are going on their self-care journey, one which focuses on their physical health. Vitamins and healthy foods are just a few ways they’re trying to shift the health dial in their favor, as shown in the growing demand for personalized health care.

Health care tools that accelerated during the pandemic, like telehealth, have become a mainstay for many. Now, personalized vitamins and gut biome tests are just some examples of how health is being explored with these individual, tailor-made characteristics.

4. Consumers are tracking data on their physical, digital, and mental health

A decade ago a step count on a phone was exciting, but then technology brands put numbers on everything. How far you’ve walked, how many sets of stairs you’ve climbed, your heart rate while walking, how this has changed over the last week, the last month, the last year? You get the idea.

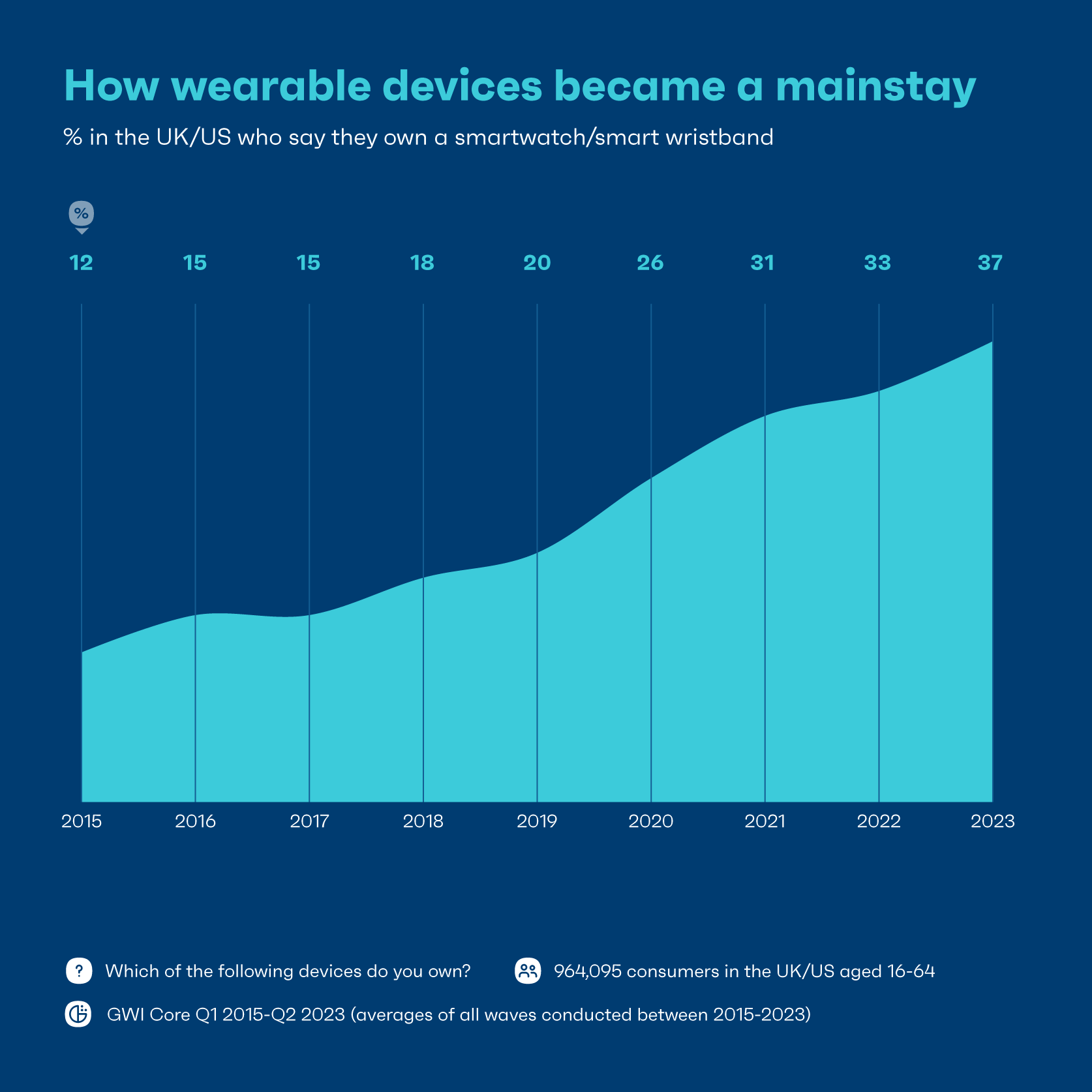

A large part of this change is the rise in smartwatch ownership. In 2015, just 12% of consumers in the UK/US owned a smartwatch or smart wristband. Today, the figure is at 37%. To give context to just how big a shift this is, the size of the growth in US ownership is roughly equivalent to the total population of Colombia, South Korea, or Spain.

What we’re trying to get across is that they’re really popular, which is reflected in how much data consumers are tracking.

Over the last two years, we’ve seen rises in the number of Americans tracking their exercise (+12%), screentime (+21%), sleep (+13%), and spending (+16%). They’re looking to keep tabs on their physical, digital, and mental health, without neglecting their day-to-day welfare too.

Smartwatch devices are more accessible than ever, and while high earners were the early adopters, ownership in the UK/US among low earners is around 2.5x higher than in 2015, so this is a wellness trend that’s here to stay. A whole host of brands can help empower them too, shown by the likes of Pokémon Go releasing Pokémon Sleep, an app that rewards players who sleep for longer.

5. More consumers want food and drink with probiotics

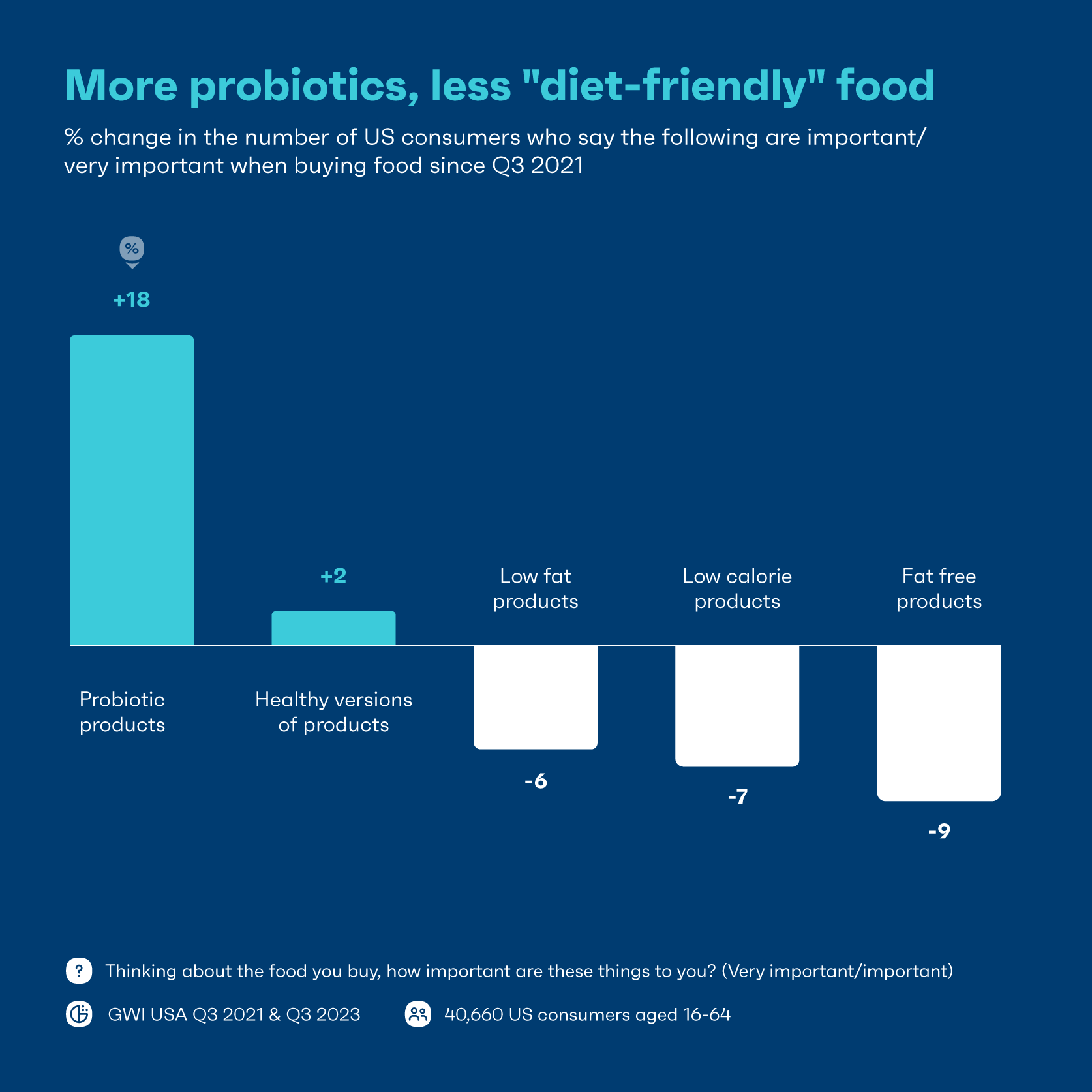

Of all the factors that are important to people when buying food, “probiotic” has grown the most, with sales of probiotic-containing drinks soaring.

Gut health issues are pretty common, and various diet trends and numerous stressful crises have had a negative impact on our digestion. The number of Americans who say they experience nausea, vomiting, or diarrhea regularly/often is at its highest point since we started tracking it in 2020, and more take supplements for digestive health. Many people are therefore making a conscious effort to keep their gut healthy.

Plus, stomach cramp complaints are growing relatively fast among fashion-conscious groups like Balenciaga owners, regular luxury buyers, and champagne drinkers – who’ll be on the lookout for trendy solutions.

Probiotic ingredients like yogurt, kefir, miso, and kimchi are likely to gain the attention of these audiences. 14% of US luxury clothing buyers say they drink kombucha tea, for example, which is double that of the general American population.

Brands who advertise these ingredients and qualities are likely to draw in new customers.

6. Restrictive diets are losing steam

Where we saw the veganism wave catch steam during the late 2010s, today the appeal seems to have lost some interest. But what’s driving this wellness trend? Well, consumers are becoming less restrictive in their diets, driving a move toward flexitarianism.

Not only are fewer Europeans engaging with diets like the keto diet, many don’t have the emotional or financial bandwidth to focus on ethical standards.

Globally, pro-environmental attitudes have started to decline as consumers are re-prioritizing their needs, and a growing sense of environmental fatigue is setting in. In Europe, the importance of sustainability when buying food has declined 10% year-on-year, while the number identifying as flexitarians has increased 13%.

For brands, there’s a potentially lucrative opportunity to target those stepping foot into, but not committing to a plant-based lifestyle. Sustainability isn’t their primary motivation, so shouting about other benefits like nutrition could help them appeal to a wider customer base.

7. Every brand is a stakeholder when it comes to mental health

It’s no secret that a lot of us are dealing with mental health issues, and among many groups the number who say they have poor mental health has increased in the last year. There’s a lot we can learn by understanding how consumer’s mental wellness changes, something that the wellness industry alone can’t answer for.

We can highlight some examples in the US to show how widespread these feelings are. The number of instant coffee drinkers, those interested in nights out and clubbing, VR/headset owners, and rum drinkers who say their mental health is bad or very bad, has more than doubled between Q1-Q3 2023.

When it comes to mental wellbeing it’s an area where every brand can be a stakeholder, and wellness brands in particular should look to share tips and tools on how to manage and support these issues. The likes of Ad Council, FIFA, and Gymshark show how brands are uniquely positioned to address the evolving needs of consumers and contribute to the broader conversation on mental wellbeing.

How brands can promote wellness in 2024

As a category, health and wellness covers a huge range of consumer interests and behaviors, and attitudes and priorities are constantly shifting.

What’s clear is that many consumers are becoming more proactive when it comes to their health, making use of the data available to them to keep tabs on their physical and digital wellbeing. They’re also busy, and don’t have the emotional energy to spend on strict, fat-free diets.

In 2024, brands will want to focus on convenience and speed, as well as making things trackable yet flexible.