Shares of General Mills Inc. (NYSE: GIS) were down slightly on Wednesday. The stock has fallen 22% year-to-date. The company is set to report its first quarter 2024 earnings results on Wednesday, September 20, before market open. Here’s a look at what to expect from the earnings report:

Revenue

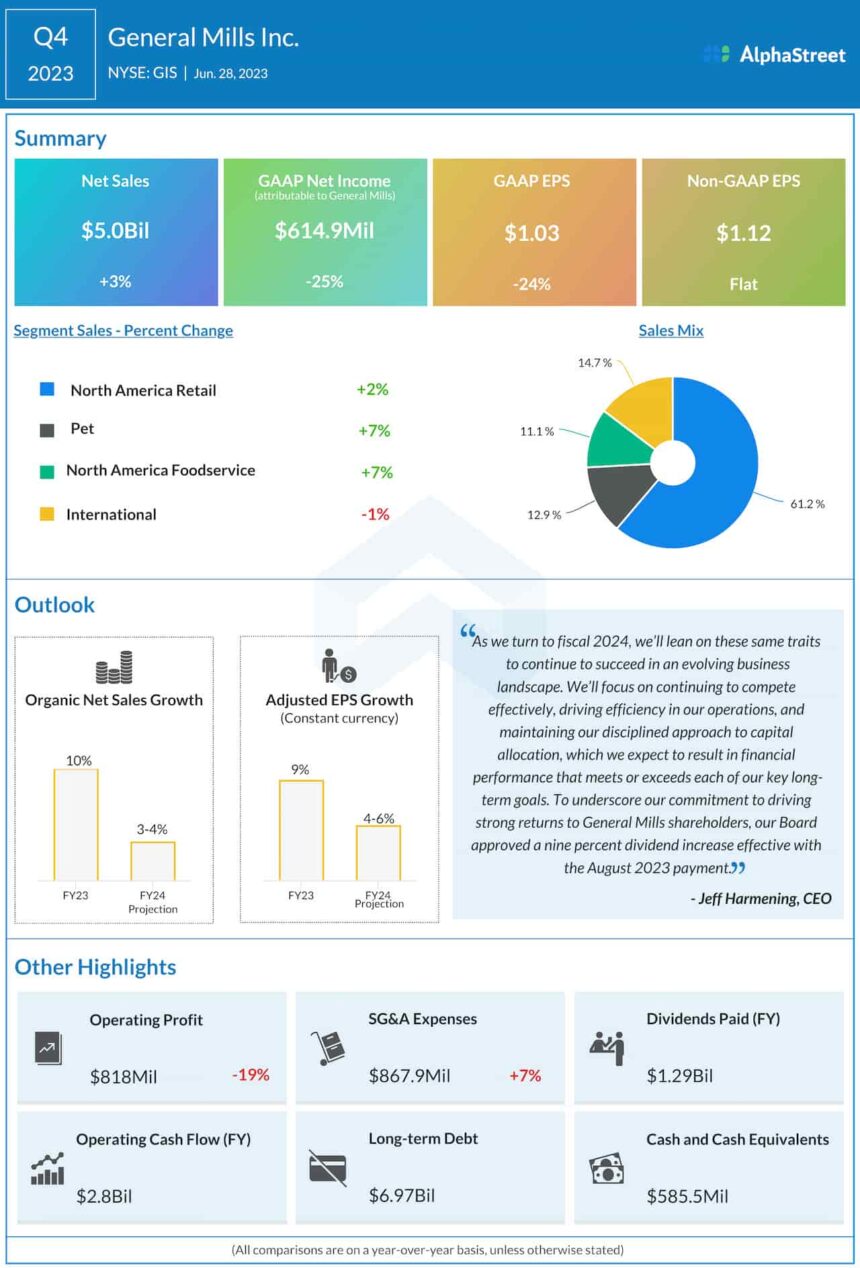

Analysts are projecting revenue of $4.8 billion for the first quarter of 2024, which would represent a growth of 3.7% from the same period a year ago. In the fourth quarter of 2023, net sales increased 3% year-over-year to $5 billion.

Earnings

The consensus estimate for EPS in Q1 2024 is $1.09, which compares to EPS of $1.11 reported in the prior-year period. In Q4 2023, adjusted EPS rose 1% YoY to $1.12.

Points to note

As stated at the Barclays Global Consumer Staples Conference last week, General Mills started fiscal year 2024 against a backdrop of moderation in inflation, supply chain stabilization, and a resilient but cautious consumer.

The company is seeing a moderation in retail sales trends for its at-home food and pet food categories as the impact from pricing continues to lessen and as customers continue to seek more value for their purchases. General Mills expects organic sales growth to surpass retail sales growth within its North America Retail segment in the first quarter of 2024. In the Pet segment, organic sales are expected to remain flat in Q1 versus last year.

The company is seeing strong momentum within its North America Foodservice and International segments. It expects organic sales growth in both these segments for the first quarter of 2024.

For fiscal year 2024, General Mills has guided for organic net sales growth of 3-4%. Adjusted EPS is expected to increase 4-6% in constant currency. The company expects a growth of 4-6% in constant currency in adjusted operating profit as well.