This blog post is part of the Saying Goodbye to MQLs blog series, where we answer your questions about making the shift from leads to buying groups and opportunities.

When beginning the transformation from MQLs to buying groups and opportunities, how we think and use signals changes. Every interaction, whether it’s digital or in person, that occurs with either a named or anonymous person creates a signal. Someone filling out a form and downloading a white paper produces a signal. An anonymous visitor to our website does too. Same with a conversation with my RDR team. The reality is that most potential opportunities have multiple different signals that are produced by named and anonymous people across the buying group.

When we only focus on MQLs, we put huge emphasis on the signal that an individual has hit the MQL threshold. And sadly, that’s often the only signal we care about. We either are blind to or ignore other signals beyond the MQL. That’s one expensive mistake to make since we are ignoring many available signals that would make our revenue process more efficient. And MQLs cost money to produce, so ignoring these additional signals leads to poorer conversion and increased waste. To transition from MQLs to buying groups, it’s crucial to leverage the insight from all available signals. To leverage these signals, it’s important to understand the context available from these signals. Understanding the context of these signals (who did an action such as the account or person and what solution they are interested in) provides the foundation you need to assemble a buying group and align it to a potential opportunity.

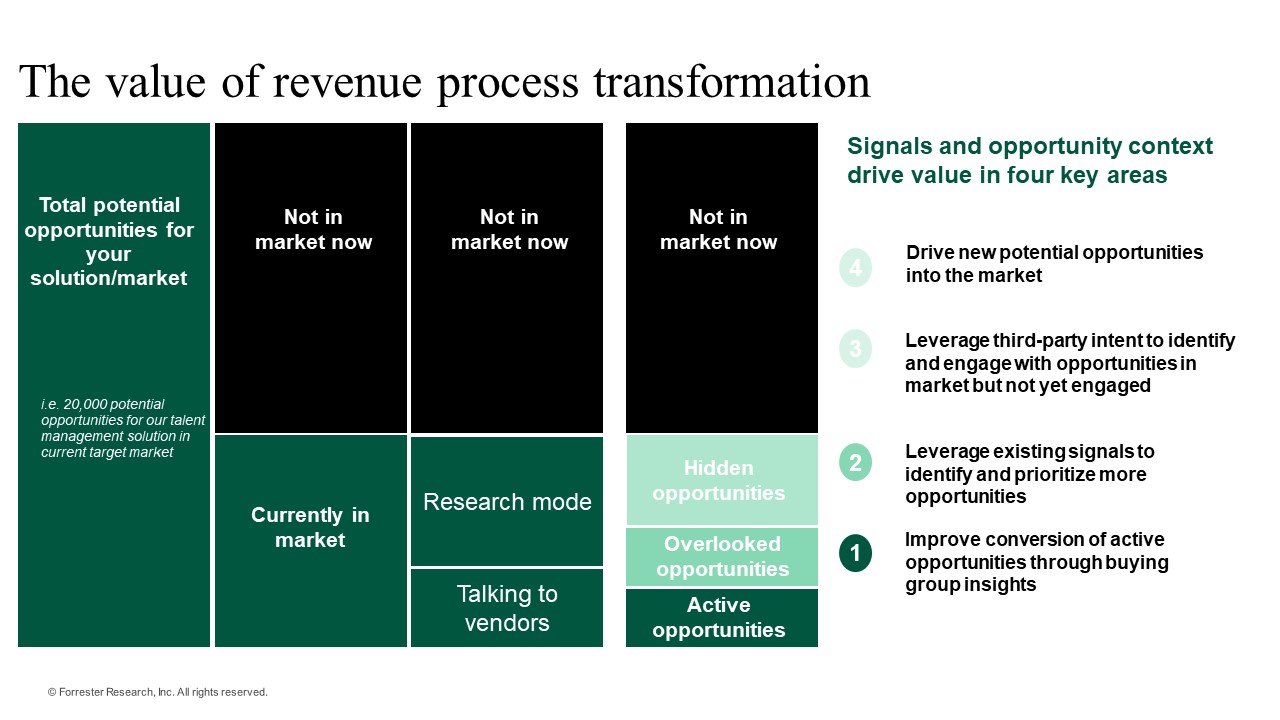

Leveraging signals to identify buying groups can drive value in four key ways. The value added varies based on the market context of the opportunity, i.e. is this potential opportunity in market, and what type of relationship or insight do we have with this potential opportunity? For example, not every potential account and opportunity is currently even “in market” and considering a purchase. We are likely working on some of the potential opportunities that are currently in market, but there are probably other in-market opportunities that we missed. Our ability to leverage signals to identify a buying group can be very valuable for each of these different market contexts. Let’s take a look.

Opportunities with active marketing/sales cycles. The issue with an MQL-focused process is that it’s fixated on a single person (the MQL) and often ignores other signals and people. Often any engagement after the initial MQL is qualified is considered duplicate and is intentionally disqualified, even though we now recognize they are part of the buying group. In reality, these disqualified people are often key members of the buying group, and sales will have to spend additional time identifying them (even though marketing knew about them). This can extend the sales cycle and negatively impact conversion rates. Instead of disqualification, we should celebrate the fact that there are multiple people engaged and package/share this info across marketing, the RDR team, and sales. Sharing this insight can be hugely valuable. We’ve had clients tell us that when they deliver three or more buying group members to sales, they see a 50% increase in their conversion rates from meetings to closed won.

Overlooked opportunities. Another major value add in leveraging signals occurs by better engagement with “overlooked” opportunities. An overlooked opportunity occurs when we have engaged with an account and buying group members about a potential opportunity, but our prioritization/scoring strategy is wrong. This happens frequently when our scoring strategy is based exclusively on the engagement of a single person and does not consider other signals. We celebrate that one person downloaded three assets, but we miss that three people in the same account each did one action. No single person did enough to trigger the scoring rule, and we completely missed the fact that three people in the same potential buying group were engaged. And it’s crucial to understand that having multiple people engaged in a buying process is exponentially more indicative of propensity to buy than the behavior of a single person. Changing your scoring strategy to recognize when signals occur across a group, along with understanding the value of anonymous (but important) actions means a better prioritization strategy and will identify additional opportunities that are currently overlooked.

Hidden opportunities. Not all accounts currently in market for solutions relevant to yours are on your radar screen today. You don’t know them, and they may not be aware that you and your solutions exist. Since we have no direct signals, we need to leverage third-party intent providers to tell us about accounts that are in market for us to concentrate our acquisition programs on. The value here is better use of signals to identify and engage in new opportunities that we are currently missing. Third-party intent insight can identify the opportunities that we’re currently not aware of, and we can leverage a combination of targeted marketing and prospecting to drive engagement and new selling cycles.

Opportunities not in market now. In addition to opportunities that are currently in market, signals can be valuable as part of a strategy to help identify potential opportunities and accounts that are brand new arrivals to the market. We never want to ignore the inactive market; we want to invest in brand awareness and reputation to build initial awareness in this market and either provide the catalyst to enter the market or detect accounts newly entering the market to build the early relationship.

Want to learn more about making this revenue process transformation? Check out the Saying Goodbye to MQLs blog series every Thursday. Have a question of your own? Send it here and we’ll respond in future blogs.