“Money is an inherently ‘multi-player’ experience – not a single-player game. But most incumbent FIs haven’t built their products or software systems to serve the collaborative needs of multiplayer finance.” – Emily Luk, Cofounder & CEO of Plenty

Believe it or not, this is our first blog on Shared Finance (in case you’re wondering, it’s hard for us to believe). So, we feel obliged to give you a definition of Shared Finance:

Any situation in which a person is acting as an observer of, partner in, or proxy for another person’s finances

Shared finance is an umbrella concept that encompasses a wide range of needs, from multi-generation households to unmarried couples to roommates to divorced parents co-funding a child’s education – and many more use cases.

We first identified and defined shared finance in 2016, and we monitored it as a growing – but still largely overlooked – trend in subsequent years. Our latest research report details the current state of shared finance: “Shared Finance Keeps Growing While Traditional Providers Ignore Rising Demand”

Here’s a quick overview of four research findings:

- Shared finance remains a latent need. A latent need is one people don’t realize they have until they’re presented with a way to solve it. It’s important to note that just because consumers aren’t actively asking for something doesn’t mean it’s a latent need. But our research continues to reveal clues (see the next bullet for example) that shared finance is one of those rare areas where people’s needs are being un-met or under-met, even if the average consumer can’t quite articulate what they want.

- Across markets, there is evidence of the need for better shared finance tools. We look at 2023 data and find that 74% of US online adults show interest in one or more digital shared finance offering (when asked “How interested are you in using the following digital tools to track and monitor, or act as a proxy for, the finances of another person?”). We found high interest in these shared finance tools across all markets we surveyed: Canada, France, Germany, metro India, Italy, Spain, the UK, and the US.

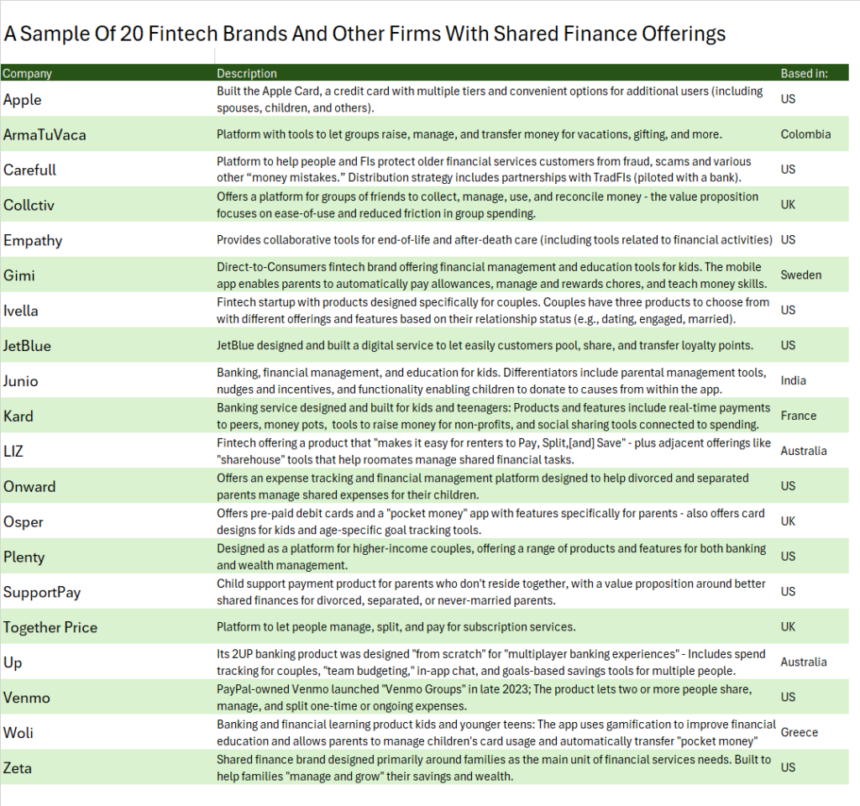

- Disruptors – including fintechs and tech titans – are ahead of incumbent FIs. We identified more than 50 shared finance offerings from fintech brands and various non-financial brands like airlines, retailers, telecoms, and more (you can see a small sampling below). What’s more striking is what we didn’t find: Innovative shared finance products from TradFIs. There are rare examples, but most TradFIs are still trying to solve 21st-century shared finance needs with 20th-century products like joint accounts.

- Ultimately, shared finance is a product innovation problem for large providers. If (as our research suggests) shared finance is a massive latent need, then revealing and meeting that need will require novel products. In the absence of new ways to manage shared finances, consumers make do with old-school products. But that will change. After all, before cars people really did want faster horses, and before the iPod they thought the discman was getting the job done well enough. Forrester urges executives and leaders at financial providers to approach shared finance as an area where the answer is not just to build incrementally better joint accounts, but to create entirely new products and services to solve people’s problems.

If you’re a Forrester client, you can read the full report. For more info on this or any of that upcoming research, contact us!